This post is sponsored by Starling Bank, but all views are my own.

Colourful card, easy to use app

Reviewing the Starling Bank current account was a relief. My main thought was: ‘why can’t all banking be like this?’.

So all hail Anne Boden, the first woman to found a British bank, who set out to make banking better for everyone.

More about Starling Bank

What is Starling Bank?

Starling Bank is a nippy newcomer to the banking world, launched in 2014. All accounts are run digitally via the Starling app, rather than using a branch network.

I reviewed the current account, but Starling also offers joint accounts, multi currency accounts, business and sole trader accounts, bank cards for children and some lending products.

Now, I’ve got a fistful of current accounts opened with the big high street banks at different times and for different purposes (interest, work expenses, cashback on bills). I got my first bank account way back in 1984, when NatWest was still National Westminster. At the time, I was gutted to be too old for the NatWest Piggy Account with the money boxes, fobbed off with an ‘On Line Account’ that wasn’t. The ads featured a strange snood-wearing female, and I was given a black plastic folder for my statements, striped with electric blue, acid yellow and fuchsia pink.

Ah, the joys of 80s stationery

Trouble is, I fear that for many of the big established banks, banking practices haven’t actually changed too much since then.

None of the other accounts I’ve tried have made banking as quick and easy as Starling.

Anne Boden had the great advantage of designing a bank from scratch, harnessing the latest technology, rather than being bogged down by the legacy IT systems that have derailed assorted big banks in recent years.

Take opening an account. It took me 10 minutes dead from downloading the Starling app to be done and dusted. All on my phone: no forms, no schlepping to a branch.

I just had to answer a few questions, set up security features, take a photo of my driving licence or passport and swear blind I’d read assorted terms and conditions. The comedy moment was recording a clip of myself reading out a four digit code. I do hope it was reviewed by an algorithm rather than a human, given I looked like Father Jack but with glasses, first thing on a Saturday morning.

I was a tad disappointed when it said my details were being checked, and the average review time was 13 (!) hours, but in the end I was up and running on the app way before that.

I could have used the account straight away, via Apple Pay or Google Pay, but my debit card zipped through the post only two days later. Plus, it’s a vibrant teal colour, which is easy to spot in my overcrowded wallet.

Action shot: Instant spending notifications and round ups

Starling Bank’s app features

Starling Bank has all the serious stuff you’d expect from a bank: it’s got a proper banking licence, has security features coming out of its ears and all accounts are protected up to £85,000 by the Financial Services Compensation Scheme.

As a frugal blogger, I appreciate that there are no fees for the ordinary personal account and no charges for cash withdrawals, deposits or spending overseas. So if you’re planning post-covid trips abroad, a Starling account will help keep your costs down. The business accounts don’t have monthly fees either.

Starling also brings together a whole assortment of useful features familiar from other fintech apps and tech-friendly banks, such as:

- instant notifications of any spending on its card

- choosing your own PIN on the app, rather than being sent one you can’t remember and having to trek to a cash machine to change it

- paying in cheques for up to £500 just by snapping a photo

- ability to ‘lock’ lost cards on the app and ‘unlock’ them when found, without having to cancel them completely and order replacements

The spending notifications really appeal, forcing me to face up to my purchases, otherwise all-too-easily ignored in a wave of contactless transactions. You’re also more likely to spot unfamiliar and potentially fraudulent payments.

Like budgeting apps, Starling automatically tots up your spending in different categories, such as Groceries, Bills and Transport, and makes it easy to change categories for different transactions.

Previous post: top 10 tips for keeping a spending diary

Like savings apps and some other banks, you can set up financial goals and ’round ups’ with Starling, where transactions are ’rounded up’ to the nearest pound, and the change is automatically added to your savings pot.

With Starling, you don’t need a separate bill splitting app. Instead, Starling lets you split transactions equally between up to 5 people, or in custom amounts. It provides a link, avoiding the hassle of account numbers and sort codes, and lets you send it straight from the app via assorted messaging services.

Like pocket money apps, Starling offers bank cards for your kids. You can set up a Kite card with only a few taps, then load or withdraw money via the app, get real-time spending notifications, and set limits on where the cards are used. For example, if you don’t want your child using the card online, or in cash machines, you can say so. Certain transactions, such as at gambling sites, escort services and video arcades, are automatically blocked.

Kite cards cost £2 a month per card. Sure, I’d rather they were free, but this compares well with competing bank cards for kids such as Go Henry (£2.99 a month per card) and RoosterMoney’s Rooster Card (£24.99 for one card, £19.99 a year for additional cards). Starling doesn’t sneak in any 50p charges for additional transfers or cash machine withdrawals either.

Quick turnaround: under a minute to activate and then use my card

Extras I particularly appreciated with Starling Bank

I’ve reeled off a long list of features that normally you’d need a phone full of apps to provide.

But what really impressed me was when Starling Bank took features further, and dealt with any issues.

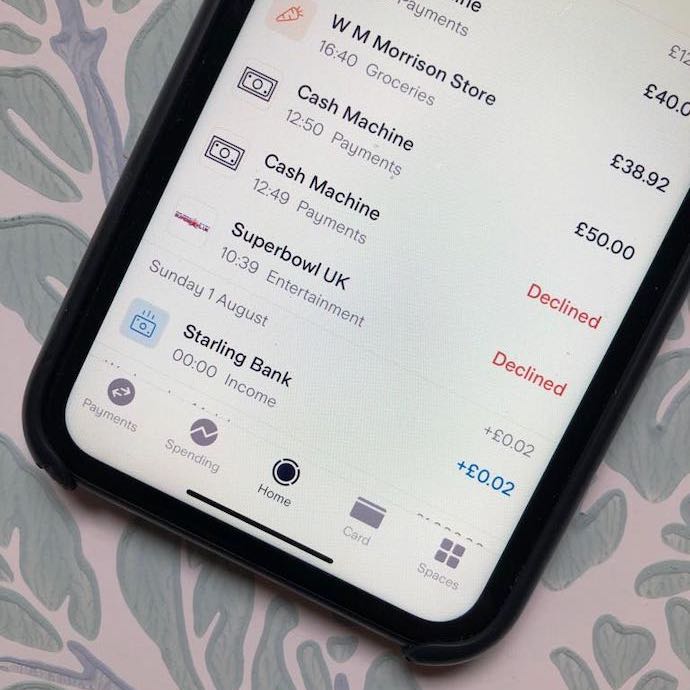

Here’s an example. When my debit card showed up, in a glamorous thick envelope like a wedding invitation, I just shoved it in my bag. Tried to use it when taking the kids bowling – no joy. Assumed I probably needed to activate it in a cash machine with my PIN, so tried that. Still no joy: ‘contact your bank’. But at that moment I also got a notification from Starling, explaining I needed to activate my card in the app, while politely not saying ‘doh, fool, read the instructions that came with the card’. So I opened the app, clicked to activate, and was instantly able to use my card then and there. Check out the screen grab above – literally a minute between the card being refused at 12.49 and then withdrawing cash at 12.50.

Same thing when I used my Starling Bank card to order an online supermarket delivery from Morrisons. A message appeared onscreen saying I needed authorisation from my bank, which made my heart sink, due to past experience of rejected credit card payments and lengthy phone calls sorting it out.

But no. I immediately got a notification on my mobile from Starling, clicked through to the Starling app and its security features, then with one tap I confirmed the payment. Super quick, very easy.

Here’s another example. I was wracking my brains about a transaction to ‘The Jugged Hare’, in my list of payments. When I clicked on the payment in the app, it showed me not only the time, date and amount, but the spending category, address and even a little map of where I’d spent it, which jogged my memory. I don’t get that with Yolt.

I also admire the way Starling Bank, as a recent start up, can turn on a dime without having to fight through thousands of layers of management.

Take Starling Bank’s reaction to the pandemic, as described in Anne Boden’s book, ‘Banking on it: How I disrupted an industry‘.

Within ten days it launched an additional bank card for customers, linked to their account, so if they were sheltering or self-isolating they could give the card and its PIN to someone they trusted to go shopping. Crucially, the card could only spend money the account holder moved into a ‘Connected Space’, capped at a maximum of £200.

For every friend you refer, Starling will plant a tree

Starling values

I also admire Starling’s commitment to assorted ethical and environmental goals, meaning you can open an account with a clear conscience.

For example, its debit cards are made from recycled plastic, its banking is paperless and Starling plants a tree for every person you refer, via a partnership with Trillion Trees.

As an organisation, Starling pays the Living Wage to employees (not just the minimum wage), aspires to be an inclusive workplace, has signed up to the Women in Finance Charter, uses 100% renewable energy in its London, Southampton and Dublin offices and 90% of its cloud spend with AWS is via a carbon neutral data centre.

Starling doesn’t invest in environmentally or socially damaging industries including fossil fuels, tobacco and arms.

However, while Starling itself does not invest in fossil fuel companies, the Qatari Investment Authority (QIA) holds a minority stake in the bank. QIA is a way for the state of Qatar to reduce its reliance on oil and gas, and also invests in companies such as supermarkets, airports and department stores.

Importantly for customers, Starling is committed to transparency, fairness and inclusion – which includes avoiding hidden and rip off fees and using plain language.

What’s not so good

There’s a lot to like about Starling Bank, but it won’t be right for everyone:

- Starling is a digital only bank – it’s all online and on your phone. If you prefer banking in branches, it isn’t for you

- Customer support is all by phone, email or live chat via the app, rather than being able to talk to branch staff face to face. Does mean help is available 24/7 though

- No cheque book, if you do still need to send cheques

- Can only connect up to a limited list of accounts via Open Banking, such as my PensionBee pension and Wealthify investments. As I can’t see all my account balances in one place, it can’t yet replace my favourite budgeting app

- No cashback on purchases or bill direct debits, teeny tiny interest of 0.05% a year on credit balances and no cash switching bribes

Starling Bank review summary

Using a Starling Bank current account has been like a breath of fresh air. It feels like Starling Bank has really focused on making banking better for its customers – and now has 2.4 million accounts to prove it.

Many of the helpful features pioneered by Starling have since been picked up by other banks and fintechs. The app packs in loads of functions that otherwise you’d need a phone full of apps to provide.

Sure, I have minor niggles about the lack of financial incentives, such as cashback, higher interest or switching bribes. Starling doesn’t shower customers with free money, but that could help explain why the bank broke even for the month of October 2020 and has recorded a profit every month since then, unlike many loss-making fintechs.

Overall, my Starling account has definitely made banking quicker and easier for me, and my husband is fed up with hearing how good it is.

Click here to find out more or open an account.

Now – over to you. Would you consider using a Starling account? If you already have one, how have you found it?

Totally agree with your review as it matches my own experience with Starling. I originally opened an account in 2018 as I wanted a card to use for free while travelling abroad and it seemed less ‘gimmicky’ than other similar app-only banks. Also, of course, I wanted to support a bank set up by a woman! This past year or so, it’s become my ‘second’ current account and I use it for my emergency funds and for easy access savings pots (I have 11 Spaces for various different goals/projects!).

Also for your info, one of the reasons why the bank made a profit was because they were quick to get on board the government’s pandemic loans to business initiative, so they were able to offer cheap/free loans to small and medium sized businesses. The loan repayments were guaranteed by the government so it was a win-win for the bank.

Author

Glad you’ve had a good experience with Starling too Weenie. Now my mind is boggling at the different purposes for your 11 saving ‘spaces’!

Will be interesting to see how the bounce back loans and other government business finance support pans out for Starling. I remember at the time that they seemed to be taking a longer term approach, thinking about the potential for borrowers to repay and turning down a chunk of applications.Should stand them in good stead rather than having to chase the government under the terms of the guarantee.

THE ONLY LEGITIMATE CRYPTO RECOVERY EXPERT….!!!

Good day Audience, I want to use this great medium to announce this information to the public about Mr MORRIS GRAY. few months back, I was seeking an online BTC investment plan when I got scammed for about $172,000. I was so down and didn’t know what to do until I came across a timeline about Mr MORRIS GRAY. so I reached out to him and to my greatest surprise, they were able to recover all the funds which I had previously lost to the Devils. I am so glad to share this wonderful news with you all because it cost me nothing to announce a good and reliable Hacker as Mr MORRIS GRAY, His direct email is Morris Gray 830 at gmail dot com, WhatsApp: +1 (607) 698-0239…..!!

When it comes to recovery of stolen or lost cryptocurrency assets, reach out to RECOVERYBUREAUC @ GMAIL C0M. Just few days ago I got tricked by a fake investment website where I lost about $245,000 to this unscrupulous scheme. After I got deceived with a 25percent ROI on my investment weekly. I thought it was a good investment not knowing it was a bait to get me out of my savings. However after days of brooding and depression I found the best cryptocurrency recovery team at RECOVERYBUREAUC @ GMAIL C0M who came to my rescue and completely recovered my stolen funds with ease and without hidden fees. He’s the real deal and reliable recovery personnel RECOVERYBUREAUC @ GMAIL C0M

RecoveryBureauC@gmail com offers five star mobile phone monitoring and assets recovery solution. The new AI technology has been the latest trick used by many fake cryptocurrency investment theft. I fell for this deceit just last week when I got a phone call from someone who impersonated my close friend and introduced me to this investment project. He describes just exactly like her and how she’s been benefiting from the profits of the investment so I decided to invest not

knowing I would get tricked. I almost lost about 858,000 USDT of my inheritance funds and money borrowed from different loan agents on this Chinese investment platform.

After few days of losing this huge funds I did thorough search for help and I found RecoveryBureauC @gmail, cOm whom I reported my situation. I opened a case with this team and they assured me of a swift action immediately. To my surprise within few hours I reached out to them they were able to retrieve the first tranche of my stolen funds and the remaining subsequently. Their services were seamless and perfect without any hassle. I’m glad I got rescued and I’ll urge you to look this firm up for all asset recovery help. Other services are phone monitoring, catch a suspected cheating spouse, tax evasion, boost of credit scores, upgrade of results, erasing of bad debts etc

Contact info:

RECOVERYBUREAUC@GMAIL.COM

WhatsApp: +44 7586 868096

Don’t get deceived by fake cryptocurrency investment websites, Ponzi schemes or via forex trading as most of these schemes are rampant on the web now luring investors into depositing money to earn profits but are all lies. Just last month I got conned by a MT5 trading website after depositing about 245,000 USD with the intent of getting 100percent monthly on my investment but it was just that I enriched a stranger as all were all lies and I couldn’t access my funds. Fortunately for me after in-depth search on the web I found the best recovery specialist at RECOVERYBUREAUC @ GMAIL C0M whom I hired and was able to fully recover my losses without hidden fees. This firm were exceptional in delivering their services from start to finish. They are worthy of all positive reviews they got on the internet. Try them out today and recover your losses without further stress.

WhatsApp: +44 7586 868096

I also recently open a Starling Account which I run along side my main current account for all my spending that isn’t a bill, savings or household expenses. I transfer a set amount each week and when it’s gone it’s gone. This has really helped me with impulse spending which got quite out of hand during lockdown.

I didn’t realise the founder had written a book, I will definitely check that out. I worked in retail banking for many years dealing with legacy systems and often wished we could rip everything up and start again!

Author

Do recommend Anne Boden’s book, fascinating if you are interested in starting a business in general, or banking in particular. Highlights the rollercoaster ride for a start up, with lows as well as highs!

Get in touch with RECOVERYBUREAUC(@) Gmail com to help you recover all your scammed funds. I got in touch with them when i was scammed by Tradestation to be precise, having deposited over $175,000 but still couldn’t withdraw any funds. They kept on telling me to deposit more to reach a certain amount but still couldn’t withdraw then it dawned on me that these people were playing games with my money. Within a week of contact, RECOVERYBUREAUC(@) Gmail com did the impossible, they recovered everything and also my ROI for the agreed duration of investment. Don’t hesitate to contact them if you need any help. They’re the Best out there

I’ve tried to open an account with Starling bank. After answering a few questions, I was told that my details were being checked. They then told me I cannot open a savings account despite the fact that I have not taken any loans in the past few years, although I have taken a mortgage and I am on the electoral list. They didn’t give any reason for the refusal. There’s no appeal process except via the banking ombudsman. The problem that if you try to apply again , in case you answered one of the questions wrongly, everything they do a check on your credit rating they leave a footprint which affects your credit rating.

How to easily recover your lost or stolen Bitcoins and USDT Few weeks back I was surfing the internet then I found a MT5 forex trading website which I decided to invest in their trade signal. At first I made 50percent profits on my investment so I decided to put in a huge chunk of my savings about $355,000 on the platform so as to receive double of my investment. Then I got tricked out of my funds it was as if I was dreaming, afterwards I started searching the internet for a legitimate and genuine recovery expert to recoup my stolen funds in USDT then I found RECOVERYBUREAUC @ GMAIL C0M whom I hired and he was able to totally retrieve my funds using his recovery tools and tech prowess. It was a smooth and swift service. Contact this recovery agent now for help at RECOVERYBUREAUC @ GMAIL C0M

WhatsApp: +44 7586 868096

One of the reasons the bank made a profit was that they were fast to jump on board the government’s pandemic loans to business initiative, allowing them to give small and medium-sized firms low-cost or no-interest loans.

Loosing your hard earnend funds to cryptocurrency theft can be very depressing and are always huge amount of money so you need to be careful while choosing an investment or trading website. Just last month I almost got conned of 65,750 USD by a fake broker I met via google ad who promised me high returns on my investment only to discover it was all deceit. I’m grateful for the amazing assistance of RecoveryBureauC @ gmail c0m who fully recovered my funds after I hired them via their support contact. I got help within few hours I reached out to this firm and I strongly testify they are the best with great service.

I was depressed some Months ago due to how frustrating it is dealing with bad credits, but reaching out to HACK VANISH via Phone: +1 (747) 293-8514 and Email: HACK VANISH (@) GMAIL. COM gave my life a new meaning, after I found him credible through positive reviews I read on a credit blog, in a twinkle of an eye, this great hacker got my credit score restored from 509 to 784 across the 3 major credit bureaus, all evictions and repossession has been wiped off, my LexisNexis and Chex system fixed respectively, to my greatest surprise, some days later, I received an E-mail confirming the approval of my pending loan application. I can confidently say 2021 was an exceptional year for my husband and I as we are proud owners of a new home and a brand-new SUV courtesy HACK VANISH, I would definitely recommend him to anyone in need of a genuine Hacker.

Hello there, as a newbie to crypto currency trading, I lost a lot of money trying to navigate the market on my own. In my search for a genuine and trusted trader, i came across Anderson Johnny who guided and helped me make so much profit up to the tune of $40,000. I made my first investment with $1,000 and got a ROI of $9,400 in less than 8 days. You can contact this expert trader via email tdameritrade077@gmail.com or on WhatsApp +447883246472 and be ready to share your own testimony

With the Starling bank, there are no monthly fees and no any detection for our regular personal, business, or joint reliable accounts of ours. And we don’t care to charge you for withdrawing cash amount or using your card services overseas.

Consult the best licensed cryptocurrency recovery team at RecoveryBureauC @ gmail c0m.

One fateful morning I was going through the internet for latest news when an ad popped in about an investment scheme. I went through their mode of operations and I saw various positive reviews about the investment project. I decided to give it a try and I earned massively. I got convinced it was a genuine investment not until I invest about $575,750 then I stuarted having issues on the platform until their website got crashed and I couldn’t withdraw my funds. This was a hell of a period for me as I found myself in a deep shit. Fortunately for me after weeks of brooding I got referral to RecoveryBureauC @ gmail c0m through a friend he had previously assisted. I gave it a shot and contacted this real deal recovery specialist at RecoveryBureauC @ gmail c0m and within few hours I made contact he recovered my scammed fortune easily with high level recovery tools. He’s the best for all cryptocurrency recovery

Email: RecoveryBureauC @ gmail c0m

WhatsApp: +44 7586 868096

Great post dude.

Howdy! I just want to give a huge thumbs up for the good data you have right here on this post.

I lost my Job few months ago,my wife left me ,could not get income for my family, things was so tough and I couldn’t get anything for my children, not until a met a recommendation on a page writing how Mr Bernie Wilfred helped a lady in getting a huge amount of profit every 6 working days on trading with his management on the cryptocurrency Market, to be honest I never believe it but I took the risk to take a loan of $2000. and I contacted him unbelievable and I was so happy I earn $22,500 in 6 working days, the most joy is that I can now take care of my family I don’t know how to appreciate your good work Mr. Bernie Doran God will continue to bless you for being a life saver I have no way to appreciate you than to tell people about your good trade management system. For a perfect investment and good strategies contact Mr Bernie Doran via WhatsApp :+1(424)285-0682 or Telegram : @Bernie_fx or Gmail : Bernie.doranfx01@gmail.com

THE ONLY LEGITIMATE CRYPTO RECOVERY EXPERT….!!!

Good day Audience, I want to use this great medium to announce this information to the public about Mr MORRIS GRAY. few months back, I was seeking an online BTC investment plan when I got scammed for about $172,000. I was so down and didn’t know what to do until I came across a timeline about Mr MORRIS GRAY. so I reached out to him and to my greatest surprise, they were able to recover all the funds which I had previously lost to the Devils. I am so glad to share this wonderful news with you all because it cost me nothing to announce a good and reliable Hacker as Mr MORRIS GRAY, His direct email is Morris Gray 830 at gmail dot com, WhatsApp: +1 (607) 698-0239…..!!

I just want to say Thank You to everyone who supported me through the years. My name is Manuel Franco, New Berlin, Wisconsin. My story of how I won the Powerball lottery of $768.4M is a bit of a tale. I have been playing Powerball tickets for 6 years now since I turned 18. I bought my first ticket on my 18 birthday. I was feeling very lucky that day because I had contacted Dr. Odunga Michael to help me with the winning Powerball numbers. I really had that great great feeling that I looked at the camera wanting to wink at it. I only did a tiny part of it and trusted him. He gave me the numbers after I played a couple other tickets along with it for $10. I checked my ticket after the winnings came online and saw the numbers were correct including the Power play. I screamed for about 10 minutes because it felt like a dream. I had won $768.4M. You can check my winning testimony with the lottery officials just with my name search. Thank you Dr Odunga. Well, his email is odungaspelltemple@gmail.com and you can also call or Whats-app him at +2348167159012 so you guys can contact him

I Need A Hacker To Recover My Lost Investment? Go To Lost Recovery Masters

Hello guys, I’m Lyne Azabal from France. In my investment with Acstons-Cc, I also lost 17 lakhs. Trading using the Acstons. cc app generated a profit of 197,153 USD after paying tax and a 25% fee, however they would not release my profit and all of my Bitcoins were frozen. I called my pals, who suggested I try LOST RECOVERY MASTERS, and to my astonishment they were able to assist me get back 89% of my money. Despite the fact that I didn’t get all of it back, I’m still really appreciative of LOST RECOVERY MASTERS

For advice on recovering cryptocurrencies, get in touch with Lost Recovery Masters You can also ask them questions about any firm you wish to deal with.

Contact them: Whatsapp (+44(7537)-105921) Email (Support@lostrecoverymasters.com) Learn More https://lostrecoverymasters.wixsite.com/recoverbitcoin2024

Too many founders start a startup to raise money not to solve real problems for users. Many startup founders get caught up in the fundraising frenzy rather than focusing on solving real problems for users which is the basic foundation to any successful startup. While raising money is truly part of the journey, the primary goal should be creating solutions that truly matter to people’s lives and in cases where this kind of fraudulent activity becomes the other of business, well I believe everyone reading this has seen or is currently facing similar outcomes in their respective investment ventures. With that being said, there’s an urgent need to create an extensive awareness regarding this issue that is fast infesting our society so as to ensure more prospective investors don’t fall prey to anymore of these fraudulent investment companies out there. I recently had the pleasure of working with J E T H A C K S R E C O V E R Y C E N T R E, and I couldn’t have asked for a better result. I was a true doubter at first , but then I thought, what’s the worst that could possibly happen? So I decided to give them a trial, Anyway 2 days into the process my Bitcoin funds of $ 209,640 was recovered by the team to my greatest surprise, I checked my wallet and the funds were all there. For the past 4 months, I struggled with anxiety and depression as a result of my choices which subsequently led to almost losing my entire life savings and also prevented me from going through with the process first time I enquired for their help but this time, with a bit of believe I changed the course of my near future and am so thankful for that. Many thanks to J E T H A C K S R E C O V E R Y C E N T R E for the exceptional service. I highly recommend their services to anyone in need of recovery assistance, you can contact the team on Telegram @ J E T H A C K S S or Email ; J E T H A C K S 7 @ g m a i l . c o m

It was on one faithful Sunday afternoon when I got a call from my friend, jubilantly she said to me and I quote ‘’ In present-day Global economy, where financial tips and crypto updates flood our internet feeds faster than we can refresh, if you’re still hoarding your wealth in the bank as the economy keeps going down faster than a poorly-built Jenga tower, let’s just say you might want to reconsider your financial strategy.’’ Out of curiosity and optimism, i excitedly jumped on the opportunity and with the guidance of my friend, it wasn’t long before I also started making profits from the platform she used but our joy was short lived. It was Barely 3 months into the investment before we started having some complications with the withdrawals. Frustration and despair struck us as we both had invested everything we had into the investment hoping to achieve maximum returns. Whilst trying to Understand & acknowledging our own mistakes towards creating the unpleasant situation we found ourselves in, we strived to improve the situation doing everything in our power to get help. On this pursuit, we stumbled upon reviews referring us to J E T H A C K S R E C O V E R Y C E N T R E Inc. ( J e t h a c k s 7 @ g m a i l DOT com or TELEGRAM : J e t h a c k s s ) . A fortunate turn of events for me and my friend Abby that saw us recover every penny we sent to the pig slaughter platform thanks to the special assistance from the Team at J E T H A C K S R E C O V E R Y C E N T R E , I forever remain thankful, we probably might not have been able to recover our funds if we hadn’t come across them. After much rumination and lessons learnt, I cannot stress enough on the importance of meaningful connections with the right persons who can impact our lies positively, shares our values & aspirations because we never know when we might need them.. Together, may we support each other’s growth & happiness.

The widespread adoption of cryptocurrencies has massively influenced its growth which has also contributed to the major rise of fraudulent activities that is being witnessed within the crypto space ever since it first gained popularity and became a legal means of growing wealth, making financial gains more accessible for investors. I remember I started having some interest in crypto when Elon Musk started tweeting about it on X formally known as twitter. My first tentative investment was in doge coin which earned me nice amounts of profits thanks to Elon’s influence on its popularity back then but I started having concerns once its price started to dip and my PNL was lower than before, in my attempt to not lose everything I bought into the idea of investing in a trading company to keep my profits growth steady. This new venture eventually cost me more than I could’ve ever imagined and at some point I wished I never got into crypto in the first place. I got to find out very late that the investment company was a scam after I had invested a huge sum of $427,000 within the span of 5 months. Today I want to use this medium to say a massive Thank you to J E T H A C K S R E C O V E R Y C E N T R E this team came through when It felt like the end of the road for me. I contacted the team through their telegram username @ J e t h a c k s s and I explained my circumstances to them and they assured me of safe recovery of my funds. Well less than 48 hours into the process and I received a deposit confirmation from Blockchain notifying me of the deposit into my wallet which I confirmed immediately. This truly is one of the best humanitarian acts I’ve witnessed in my entire life because it requires an ethical recovery company to be this transparent in their process and keeping to their words, for that reason I strongly recommend their services to all and sundry, they will definitely be of help. Their email address is below as well J E T H A C K S 7 AT G M A I L DOT C O M

After what seemed like a lifetime in one career, I decided to start exploring new areas of financial growth as part of my retirement plan. At the time I considered several options but the age barrier wasn’t really going to allow for some certain new ventures although I had a few options in the table, I decided to try the crypto market. That was a very audacious decision for me but I thought I had it all figured out with my aid who was tasked with the duty of managing my investments and trades upon my registration with the trading platform. I started out with a small amount before eventually going on to invest more than I had originally intended courtesy of the high profits generated during the trading period. All the funds will be of no use to me if I couldn’t access them, this led me to destroy myself financially trying to keep up with the incessant payments they requested of me before I could withdraw funds. This went on for months before I finally summoned up enough courage and decided to seek for external support which brings me here today for I believe there’re many others in this unpleasant similar situations because of these scammers and with little to no help while the real culprits are still out there. it’s just like they say ‘’Success is the sum of small efforts, repeated day in and day out.’’… so with the right help, the chances of retrieving your lost funds to scam investments is still very much alive. I got adequate support from J E T H A C K S R E C O V E R Y C E N T R E in getting my funds recovered after I found myself in what proved to be a pig slaughter scam . I lost everything I had in my name to the fake trading company but all thanks to J E T H A C K S R E C O V E R Y C E N T R E in recovering my funds back to me and in doing so, they brought happiness back into my family. I can only share this on here so that whoever may find themselves in situations like this or have been victim of scam in the past can hurriedly reach out to them for help. They are active on Telegram with the username @ J e t h a c k s s and Email : J e t h a c k s 7 @ g m a i l . c o m

Loosing and Recouping back my funds has been an unforgiving grind-but I learned a lot along the way. For those embarking on this path, here’s everything you need to know: All things equal, a hacking team with more Experience and ability to systemize will win against an audacious company whose ability to defend their systems/data against such superior intelligence are impossible to orchestrate. J E T H A C K S R E C O V E R Y C E N T R E is the team that did it for me and as well many others before me. I found the team through google and coming to work with them, they have been nothing but the best. Their help have been so helpful and they made sure to always carry me along throughout the whole process of recovering my funds by always replying to my unceasing emails Via their email support @ J e t h a c k s 7 AT gmail DOT com right up until the very moment that my case got completed. The entire process lasted for less than 72 hours, in that short period, I watched my funds which I thought possibly had been lost forever get recovered back to my wallet, as It would turn out the trading company had been all along extorting money from me just like I had earlier suspected with zero intentions of ever releasing a single penny to me. Thankfully we’ve got teams like J E T H A C K S R E C O V E R Y C E N T R E to help us out in situations like this where we neither posses the skills nor the ability to tackle fraudulent companies that always try to take advantage and in doing so, they cut down on the amount of damage done which could’ve been worse had it not been for their helpful intervention. Hopefully, someday there will be a regulated crypto space completely free of fraudulent companies trying to rip us off and Lastly, the team is also operative on Telegram with the username @ J e t h a c k s s

My process for recovery has been kind of a bumpy process because of the fake recovery agents I encountered earlier on, however with the support given to me in the consultation and during my one on one conversations with the Team via their telegram account ( @ J e t h a c k s s ) J E T H A C K S R E C O V E R Y C E N T R E and I have collectively succeeded in recouping my locked up BTC Assets valued at $326,790 within the space of 48 hours !! Or rather the team worked hard on my behalf, I only had to provide them with a few details regarding my investment with the fraud company and they did the rest for me. Prior to meeting J E T H A C K S RECOVERY CENTRE, i had met a few recovery agents as well that only seemed to care about their service fee similar to what the fraud company was doing to me and at some point I almost gave up the believe that I would ever get back my money but today, I’ve done full circle to come back here and give my own thankful review since I learnt about the team through the many reviews on here. I feel ready to take on the world with my new found awareness and J E T H A C K S on my team! … I wish they would create more awareness platforms and opportunities to help enlighten more people about crypto and how best to navigate the digital financial landscape, this will surely help to reduce the fast spreading fraudulent activities going on there and save potential investors from falling prey!. Glad I know it now and I can teach it to my children so they wont make the same mistakes I did. You can also contact them via their official email address ( J ET HAC KS 7 @ GMAI IL. COM )

Hi Everyone, This is my story. I was scammed by a cryptocurrency investment company by the name Altercoin and Based on its website, it’s a British company. Everything began January 12, 2024, with a deposit of $300.0 USD to open trading account. Shortly after investing, Their system started generating decent profits , In the first week of February 2024 their system generated a 158% profit in one week approximately $60,000 USD. Altercoin employee Danny Nixon, an English man asked for additional capital to balance the profit, After the additional capital provided, they liquidated my trading account at the financial department request and placed the transaction on hold, After which they asked for more funds for various reasons which I did pay as well but still the funds was not released to my wallet so this got me very concerned and I decided to carry out an investigation on my own , I discovered later that they were on paper and the whole account was fake. I was left devastated and feeling crushed so I had to confide in my friend about everything that’s going on, he advised we hire a professional recovery company to trace down all my deposits and payments to Altercoin and have it retrieved, he’s well oriented in tech stuff so he recommended we seek out the professional help we needed from J E T H A C K S R E C O V E R Y C E N T R E ( J e t h a c k s 7 @ G M A I L . C O M / Telegram username @ J e t h a c k s s ) which we did and At first, I had to provide the team with some proofs of my investment and contract with Altercoin before they could proceed to recover my funds. I must thank the team at J E T H A C K S R E C O V E R Y C E N T R E for how professional they were in handling my situation, demonstrates a commendable level of commitment and dedication to helping his clients such as myself recover our funds stuck in the hands of dishonest financial setups. To anyone reading this and is in need of recovery assistance, you can also contact the team to help you.

Recovery companies/firm has played a crucial role in curtailing financial thefts by providing services to underserved populations who were unjustly exploited or targeted from their previous finance practices and investments, However, there will always be bad eggs in the groups like the first 2 firms I contacted before J E T H A C K S R E C O V E R Y C E N T R E arrived and saved the day. J E T H A C K S R E C O V E R Y C E N T R E and team have disrupted traditional financial services, offering innovative solutions that challenge established financial institutions and banking related frauds setting the standards for true excellence in this field. Unfortunately The knowledge and experience i have gained from my painful ordeal with the fraudulent platform that nearly succeeded in taking my money came at a great cost one that I had imagined would be the ruin of me. I lost my entire life savings of almost half a million dollars to a binary trading platform introduced to me by a lady I connected with on LinkedIn, she had provided me with all sorts of documents and proofs to collaborate her testimony which I later discovered were all fakes. I blamed myself deeply for trusting her words and being a novice in the industry, i fell for her game of numbers, I believed I actually had a real balance of huge profits and before I realized what was happening I had already invested everything I had saved up with them. I couldn’t bear the loss so I set out looking for help, it wasn’t an easy decision picking the right company to consult as I came across many different recovery agents/companies but in the end, it was worth the risk. I decided to go with J E T H A C K S Team on my third attempt through one of their contact channels on Telegram @ J E T H A C K S S and I explained my plight to the team, well to round up my story, the team recovered my funds from the scam company in 72 hours of serious efforts unlike the previous recovery companies. Also the team is active on email support J E T H A C K S 7 @ G M A I L . C OM

I want to start by saying a massive thank you to J E T H A C K S R E C O V E R Y C E N T R E, all in all this team have been pivotal in helping me get back on my feet again so I feel like I owe them a great deal of appreciation. If things went well, I promised myself I would come back here to share my own personal review when I first read about their services from previous friends online, well it’s safe to say the team exceeded my expectations with the results they achieved just within the 48 hours period of recovery much to my biggest surprise. The fact is, this team have got the much required versatile knowledge and experience to accurately maneuver the crypto space and make the impossible happen and that was exactly what I needed in my then moment of desperation, and it surely influenced my decision to go with them. After what happened with the telegram platform that deceived me, I just couldn’t afford to fall into the wrongs hands again so for me it was all about results and J E T H A C K S R E C O V E R Y C E N T R E came highly recommended, so I took their contact details which were attached to the reviews are Email address : J E T H A C K S 7 @ G M AIL . C OM and Telegram via the username @ J E T H A C K S S and I messaged the team thankfully they responded back, I reached out to them on a Sunday afternoon and received notification the following Wednesday that my funds had been successfully retracted into my wallet, which I quickly checked and confirmed it. If you find yourself in a similar situation, you can contact them directly using any of their contact information above.

There is a big shift in the understanding that people have of what “dating apps” are for-mostly because they’re called “dating apps”. Modern dating apps are an entertainment product: a gallery of people in your area and someone will occasionally like your photos. Unfortunately some people have decided to make the dating app space unsafe for casual people who simply wishes to use the app for its primary purposes. Nowadays, when you join a dating site, there’s a 99% chance that you’re going meet these people always trying to pitch an app/ company that they claim is a more effective way to save and earn money some even go to the lengths of building a romance relationship with you first before manipulating your feelings towards investing in some sort of financial setup. I had plenty of experience with the likes of these individuals. However I later fell victim to one lady I had met on hinge her name was Tonya, I actually met up with her one time, I never knew that these crypto scammers actually operate in real life as well. She always came up with some sort of excuse whenever I suggested we met up again, I felt I didn’t make a good first impression and tried making up for that by buying into a referral program she dealt with , I invested a total of $320k within 4 months but when I insisted to see her again before going further she stopped responding to me and blocked me on all platforms. I didn’t know what to think or believe but I was sure of one thing, Tonya was a fraud. I quickly started scorching the internet for best possible means to recover sent crypto funds, this led me to a podcast where I learnt about how J E T H A C K S R E C O V E R Y C E N T R E has recovered stolen/scammed crypto assets for individuals, without further hesitation I messaged the team through Telegram on their official Telegram handle @ J E T H A C K S S and asked for their help, thankfully the team successfully recovered back the 320k worth of USDT assets I sent to the company address after 48 hours and I feel so fortunate to have been able to get the right team otherwise I have no idea what could’ve become of me.

I recently had the unfortunate experience of falling victim to a cryptocurrency skam, losing a significant amount of fund in the process. Feeling helpless and frustrated, I reached out to Refund Polici Recovery service for assistance. From the moment I contacted them, I was met with professionalism and understanding.

Their expert, Sam, went above and beyond to guide me through the recovery process. They demonstrated a deep understanding of cryptocurrency systems and utilized their expertise to trace and recover the funds that I thought were lost forever.

Not only did Sam helped recover my assets, but he also provided invaluable advice on how to enhance my security measures to prevent future incidents. Their dedication to helping clients reclaim their stolen funds is commendable, and I am incredibly grateful for their assistance.

I highly recommend Refund Polici Recovery Company and Sam to anyone who has been the victim of a cryptocurrency scam. Their professionalism, expertise, and commitment to their clients make them stand out in the industry. Kudos to Sam and Refund Polici Recovery Company for restoring my faith in the possibility of recovering lost funds. I will repay their goodness with dropping the reachouts here just because i know someone may be in thesame situation was

Wassap : +1 ( 6 5 7 ) 2 6 2 4 4 8 2

R E F U N D P O L I C I (AT) G M A I L (DOT) C O M

Sometimes last month my spouse started

misbehaving and acting weird she’s clingy with

her mobile devices which made me develop a

suspicious mindset towards her phone activities so I became curious to know what she’s been doing on her phone lately so I searched the internet for the best and efficient phone spying expert I found RecoveryBureauC through Mspy reviews from a trusted and verified user so I decided to give this tech genius a try to know if he can truly help me in my case. Fortunately for me it was the right step and best decision. I reached out to him via his contact address at RecoveryBureauC @ g mail, cOm and told him about my situation and he promised to deliver a satisfactory service at the shortest time possible which he did. I hired him and within few hours all information from her phone and internet activities popped in and it was as if I got her phone in my palm. I got to know she’s been cheating all along our relationship with a guy downtown which got me infuriated I’ve been channeling my resources in terms of affection, time and funds wrongly. I became depressed and when I showed her all proof and evidences she couldn’t deny it. It was all like a dream to me but kudos to the tech prowess of RecoveryBureauC via gmail, cOm who rescued me. WhatsApp: +447586868096

At Facebook, I connected with a crypto investment group called Capitalix fx. Every year the group manager would select their top 30 most active investors getting well engaged in the trading activities in the group and reward them accordingly through a variety of trading packages including a multi-investors package where you can invest together with a certain group to unlock a 500% profit return. Selected Investors would quickly top up their portfolio balance and alert the VPs of their group who will in turn confirm their buy-in, then we’re supposed to await the trading period of 2weeks before receiving our returns. Last year, I was among the 30 selected investors even though I was still in my first 6 months, I was quite surprised but I then It felt like an opportunity to amass more profits from the company, so I quickly gathered as much funds as I could and deposited into my account as per the companies terms and conditions. One week in and the company website shut down, i tried speaking with the group admin but she wouldn’t respond to any of my messages and she went on to remove me when i threatened to report her account. I resorted to hiring a hacking recovery company in a last ditch attempt to save my family, I had lost everything and we were now feeding from hand to mouth. As luck would have it, I came to know about a reputable and trustworthy recovery company J E T H A C K S R E C O V E R Y C E N T R E through a twitter post which quickly prompted me to get in touch with the team using one of their contacts info that I had copied from the post Email: J E T H A C K S 7 @ G M AIL . COM or Telegram username @ J E T H A C K S S . It didn’t take long before their team responded to me and they accepted to take on my case after reviewing everything, within 48 hours the team anonymously extracted back my funds from the scammers back into my wallet, they’re my knight in shining armor and I strongly recommend them to everyone else out there

Most recovery companies will take your money again. I personally think they are the same set of people that run all of them, seems like an unending cycle and its too sad. The most crazy thing about the whole internet thing is how you can clone a website to make it look like the real one, I discovered so many people fell into this kind of scams. The only recovery company I know that works is RECOVERYBUREAUC (@) Gmail com , I have been to their physical address to meet them before and the good thing about them is that they will let you know if they can handle your case or not. So they will not just take your money when they already know they wont help you out.

WhatsApp: +447586868096

Ladies & gentlemen, l’d like to introduce you to JETHACKS RECOVERY CENTRE ( JETHACKS 7 @ GMAIL .COM / JETHACKSS ). I worked closely with this team on the case of recovering my lost Bitcoin assets after reading many impressive testimonials about how they are able to help scam victims. Locating this recovery company wasn’t completely a smooth journey, I was forced to think outside the box if I was ever going to have a chance at regaining access to an overdue lifetime worth of investments stuck with a binary option trading company. So this was what happened to me, typical scammer routine… I met this broker on Instagram , he convinces me to invest with a certain binary options trading company that he brokers for , initially I started with a small amount which he guaranteed would be appropriately managed but in actuality, it was all a fake balance so the numbers I witnessed grow in my account over the months were fake, everything started to unravel when I decided to withdraw a nice percentage of my profits so I could purchase a more comfortable home for my family. At first I wasn’t sure what I was dealing with even after clearing some fees I was still not able to access the funds so it was really affecting my mental health but I later came to learn that the whole operation was organized by the broker agent and the website was only a clone of the original website so all payments were directly into his wallet never the real company thanks to JETHACKS RECOVERY CENTRE E for opening my eyes to this. By definition, hackers are very private but they were the only ones that could possibly salvage my situation since this was a cyber scam issue and I am really thankful I didn’t deal with the unethical ones because they’re many of them that end up causing more damage to you, the team kept to their words and recovered back my funds from the scammers wallet within 48 hours.

RecoveryBureauC@gmail com offers five star mobile phone monitoring and assets recovery solution. The new AI technology has been the latest trick used by many fake cryptocurrency investment theft. I fell for this deceit just last week when I got a phone call from someone who impersonated my close friend and introduced me to this investment project. He describes just exactly like her and how she’s been benefiting from the profits of the investment so I decided to invest not

knowing I would get tricked. I almost lost about 858,000 USDT of my inheritance funds and money borrowed from different loan agents on this Chinese investment platform.

After few days of losing this huge funds I did thorough search for help and I found RecoveryBureauC @gmail, cOm whom I reported my situation. I opened a case with this team and they assured me of a swift action immediately. To my surprise within few hours I reached out to them they were able to retrieve the first tranche of my stolen funds and the remaining subsequently. Their services were seamless and perfect without any hassle. I’m glad I got rescued and I’ll urge you to look this firm up for all asset recovery help. Other services are phone monitoring, catch a suspected cheating spouse, tax evasion, boost of credit scores, upgrade of results, erasing of bad debts etc

Contact info:

RECOVERYBUREAUC@GMAIL.COM

WhatsApp: +44 7586 868096

Embarking on a recovery journey can feel daunting, especially when burdened by debt and financial struggles. However, for many individuals like myself, it’s a journey of Hope, resilience, and ultimately, triumph. Having lost a huge amount of investment to a stock exchange company kind of made it hard for me to trust any other online dealings whatsoever but when my debts started closing in, I knew I had to recover my investments or risk losing my house and every other asset in my name so I made some research online for any helpful informations, on this pursuit I learnt about Recovery Companies but choosing the right one to go with was very hard but i decided to trust my instincts and reach out to J E T H A C K S R E C O V E R Y C E N T R E, I don’t know what I would’ve done if I didn’t found this team, I took note of their contact informations ( J e t h a c k s 7 @ Gmail . com / Telegram ID : J e t h a c k s s ) and what a bless day that was, as soon I contacted the team, all my debtor’s stopped harassing me, I was able to get them off my back after clearing out all my outstanding debts with my recovered funds, and made easy payment plans with some of them. Few months ago I had lost my tire business and nobody financed me..today thanks to J E T H A C K S R E C O V E R Y C E N T R E, I finance three trucks already, my company is doing good, I’m working with UPS, and I have recommended them to a friend of mine as well and will continue to recommend them to anyone in the near future. Very professional and easy to work with, thank you Team, a thousand times thank you

When it comes to recovery of stolen or lost cryptocurrency assets, reach out to RECOVERYBUREAUC @ GMAIL C0M. Just few days ago I got tricked by a fake investment website where I lost about $245,000 to this unscrupulous scheme. After I got deceived with a 25percent ROI on my investment weekly. I thought it was a good investment not knowing it was a bait to get me out of my savings. However after days of brooding and depression I found the best cryptocurrency recovery team at RECOVERYBUREAUC @ GMAIL C0M who came to my rescue and completely recovered my stolen funds with ease and without hidden fees. He’s the real deal and reliable recovery personnel RECOVERYBUREAUC @ GMAIL C0M

RECOVERYBUREAUC @ GMAIL COM offers the best elite and legitimate cryptocurrency and digital assets recovery service. Just 2 weeks ago I lost all my cryptocurrency about £105,000 in my CoinGate account to a fraudulent investment website and a Ponzi scheme project. This got me depressed and I started looking for a way out of my bad situation fortunately for me I was able to hire the recovery prowess of RecoveryBureauC @ gmail c0m after several search on the web for a reliable service. I wrote this firm immediately and they gave me their recovery procedure which was topnotch. To my greatest surprise within 4 hours I contacted them they were able to recover all my lost and stuck funds on these platform through their high level recovery technique and this was marvelous in my sight. That is why I need to share this amazing service to everyone out there looking for a genuine fund recovery assistance should contact and file a report with RECOVERYBUREAUC Recovery Service now for instant spot on solution.

WhatsApp: +44 7586 868096

Last month I got ripped off about 245,000 USD in a pig butchering theft where I got contacted by a fake broker who introduced me to trade signals stating I could earn about 15percent profit on my trades so I gave it a try. At first I earned profits with little funds at the long run when I decided to input large funds I found out I couldn’t access my trade or withdraw my profits then I knew I’ve been cheated. Then I came on the web despite being an unsafe place, fortunately for me after thorough search I found RECOVERYBUREAUC @ GMAIL C0M with many positive reviews on asset recovery so I hired them and truly within few hours I could recover part of my stolen funds then the remaining subsequently. This was indeed a great assistance, report all theft cases to this specialist for ease retrieval. He’s the best and real deal

Consult the best licensed cryptocurrency recovery team at RecoveryBureauC @ gmail c0m.

One fateful morning I was going through the internet for latest news when an ad popped in about an investment scheme. I went through their mode of operations and I saw various positive reviews about the investment project. I decided to give it a try and I earned massively. I got convinced it was a genuine investment not until I invest about $575,750 then I stuarted having issues on the platform until their website got crashed and I couldn’t withdraw my funds. This was a hell of a period for me as I found myself in a deep shit. Fortunately for me after weeks of brooding I got referral to RecoveryBureauC @ gmail c0m through a friend he had previously assisted. I gave it a shot and contacted this real deal recovery specialist at RecoveryBureauC @ gmail c0m and within few hours I made contact he recovered my scammed fortune easily with high level recovery tools. He’s the best for all cryptocurrency recovery

Email: RecoveryBureauC @ gmail c0m

WhatsApp: +44 7586 868096

A fraudulent investment trading platform misled me into investing on their platform with the promise of a 15% daily profit, but I culminated up losing roughly £76,000 worth of cryptocurrency. I was losing everything to the point that I struggled to finance my expenses or support my family. I was utterly ashamed of myself and felt moderately disappointed in myself. A recovery masters RECOVERY BUREAUC recovery was found when I had to conduct a google search. cryptocurrencies funds can be recovered from lost or stolen cryptocurrencies by RECOVERY BUREAUC Recovery, an entity that specializes in this field. In my favor, they were able to retrieve my monies once I quickly contacted them and explained my situation. To any victim out there seeking to get their money back, I’ll suggest RECOVERY BUREAUC @ GMaIL COM

A few months ago my financial situation was basically a mess but Today, I’ve been very pleased with the work done by the professional Team at J E T H A C K S R E C O V E R Y C E N T R E in helping me restore stability in my financial life and for that am very grateful. I was introduced to J E T H A C K S R E C O V E R Y C E N T R E by Mr. Phil Crescenzo of Acre Mortgage. Before then , I also heard stories both good and bad about recovery hackers and the possibility of recovering lost/stolen assets But like most people, I assumed that if it were the real deal I would have heard about it on the news or something until Mr. Phil here whom I know very well in person recommended them to me, without any further delay i enquired with the team via their Telegram account @ J E T H A C K S S on the possibility of getting my funds recovered to which they responded promptly and assured me my case would be dully resolved after they had performed their initial verifications and tracing process. The team was clear and specific on the process involved in recovery exercises, I knew It was never going to be an easy task but I wouldn’t have had it any other way. Everything worked just like Mr Phil and the team assured me earlier on, I got my funds recovered from the fraud company I invested with within the span of 48 hours after being stuck for approximately 5 months, this team is the real deal. I would recommend J E T H A C K S R E C O V E R Y C E N T R E to anyone who is looking to get a second opinion from experts before getting involved with any online financial investment or looking to recover their already lost assets, they’re also available on Email : J E T H A C K S 7 @ G M A I L . C O M

My name is Brett Newman and I’ve been a victim of the Chinese Pig Butchering Scam recently. I have been scammed $410,000 during this Chinese fraud. I lost all my life savings. Just now, I read a news article regarding the Pig Butchering Scam in Delaware. In 2022, The Delaware DOJ initiated a halt to the Pig Butchering Crypto Scams and issued a cease and desist order to wallets, accounts, and individuals involved in pig butchering scams and I just wish the culprits behind mine also would meet the same fate. I will briefly write about the process in which I was swindled by a foreign investment company. Since I was scammed, my life was ruined. I watched the fake website all the time, hoping someday it could be shut down by the authorities and FBI which I reported to but months went by and nothing happened, I even sent a report to the Singapore police several times as the scammer mentioned they were based there but nothing serious ever came out of their investigation till I got acquainted with J E T H A C K S R E C O V E R Y C E N T R E through an article about a previous scam victim who recovered back her funds with their help. Fortunately, I kept all the evidence, including the woman’s voice, her fake photos and her fake telephone number. I also keep the communication between her and me online chat (a Japanese WeChat) which I shared with the team. I knew it would take a lot of effort but thankfully the team at J E T H A C K S R E C O V E R Y C E N T R E are exceptionally good at what they do so it took them approximately 48 hours to have my funds traced down and extracted back from the scammers account into my wallet which I quickly withdrew to my bank. I hope this information is helpful to anyone in similarly situation right now , you can use the following contact info to locate J E T H A C K S R E C O V E R Y C E N T R E ,

Telegram ID : J e t h a c k s s

Email: J e t h a c k s 7 @ g m a i l . C o m

I was unfortunate to invest with a fraudulent platform I connected with on Telegram. The elaborate scam hooked me for about 4 months before I got to realize that it was a fake business thanks to an awareness product I read on Quora, which urged me to take out my money but then it was already too late as they denied all withdrawal attempts while demanding I settle some fees first. The fake website: enkuuex .com run until 10 march 2024 before it shutdown, this encouraged me to take action against the cybercriminals and pursue a Recovery case through JETHACKS RECOVERY CENTRE. I thought, If their website could shut down it is likely that the stolen money could be retracted back. When I reached out to their customer support by email ( Jethacks 7 @ gmail . com ) asking for a review I received a reply within an hour which speaks volumes about their professional level. I also presented a description of my investment with the fraud platform, the receipt for all payment to their wallet address that I had originally thought was being invested along with a copy of the contract agreement to the team before launching the recovery process. Due to past experience, I couldn’t help but worry about the outcome of the process and although I hoped for the best, but I was prepared for the worst. However, I couldn’t have asked for a better outcome than this one, my funds was successfully recovered back from the fraudulent platform just within 72 hours of professional work from the team at JETHACKS RECOVERY CENTRE which has saved my life and any further embarrassments that this has caused me. You can also contact the team on Telegram username @ Jethackss for further assistance directly

I very highly recommend J E T H A C K S R E C O V E R Y C E N T R E!. After struggling for months to get my funds out from a fake investment platform, I investigated my options and found J E T H A C K S R E C O V E R Y C E N T R E. I never thought anyone would actually be able to get my funds out and if so it would take only the best to be able to pull it off. I was very hesitant as it was going to cost me a fair bit of money and I wasn’t even sure if they would truly be able to get the funds recovered but I can say today that they are the absolute best. I communicated with the team on Telegram via their username @ J E T H A C K S S who from the very get go told me the exact procedure, gave me all my options, was extremely honest with me and made sure to keep me informed throughout the whole process without me having to follow up even once and when I did want some extra in-between confirmations/updates, they were very efficient in getting back to me with the required information. My funds was removed from the fake platform holdings in just over 48 hours and every step was an absolute pleasure, even when my funds was finally completely retrieved and at my full disposal, They sent me a reading material to in detail explain to me about the complexities of online investment strategies and how I can better it going forward, what to avoid and how to make decisions which will best impact my Financial Stability. Not only do I recommend J E T H A C K S R E C O V E R Y C E N T R E but I also vouch for their services, they are through and through top professionals who knows what they are doing and will make sure your case gets handled in the best way possible. You can also contact them on Email : J e t h a c k s 7 @ g m ail .com

Over the years, J E T H A C K S R E C O V E R Y C E N T R E has consistently came to the rescue of victims of all sorts of financial frauds recovery cases against fraudulent financial institutions and am happy to be added to the list of people that have been lucky enough to receive their most beneficial assistance in recovering back my USDT assets. A few months ago, I was misled into invest in a certain platform with high potential returns not knowing i was going to end up getting scammed, apparently i was dealing with scammers posing as the companies executives and provided me with a cloned website enabling themselves to divert all my funds into their personal wallet, which led to their inability to pay out my profits at the due time but instead, they resorted to more sketchy means to obtain more payments from me. I turned to J E T H A C K S R E C O V E R Y C E N T R E in a last ditch effort to avoid filling for bankruptcy, the scammers left me in a very terrible position. Today I want to use this opportunity to thank you Sir and your whole whole team for everything you have done to save me and my family . In less than 4 days of working with you, my lost USDT funds of $2.6 million got recovered back to me and I am now able to settle all my debts and pay off my two daughters college tuition fees that I wasn’t able to afford before coming to you for help. Your team were nothing short of amazing and professional and very easy to work with and i couldn’t have imagined any better recovery firm to handle my case. I have already recommended you to a friend and I will definitely recommend you to anyone needing help with their recovery case to get in contact with you and the team on Email address : J E T H A C K S 7 @ G m a i l . C o m or on Telegram username @ J E T H A C K S S