Stormy times for the stock market

Puzzling over where to invest your money for the best results, whether Vanguard LifeStrategy or a robo adviser like Nutmeg or Wealthify?

Time is running out to choose a home for your £20,000 individual savings account (Isa) allowance for 2019/20, before the deadline on Sunday.

So if you’re lucky enough to have spare money to set aside for several years, and brave enough to cope with plummeting stock markets, here’s an update on my own rollercoaster experience over the last two years.

I love the theory of robo advisers, offering slick websites and managing your money for relatively low fees. But in practice, do they deliver?

Back in 2018, I was frustrated by the lack of performance figures from this new breed of investment websites.

So I bunged £1,000 into three different robo advisers, Nutmeg, Wealthify and Moola, to see what happened. As a comparison, I also put £1,000 in a Vanguard LifeStrategy fund. Vanguard isn’t a robo adviser, but I reckon the LifeStrategy funds offer a similar low cost one-stop-shop for new investors.

Previous post: Which Vanguard LifeStrategy fund is right for you? [Collaborative post]

I posted the results of my investments after a year, when everything in the garden was rosy.

Now I’m back with the results at the end of the second year, just after global stock markets collapsed under coronavirus, ending almost a decade of rising prices.

Read on to find out how they did!

Pin for later:

Table of Contents

Farewell Moola

Posting an update on my robo adviser investments is tricky when one of them closes down.

Yup. Farewell Moola.

I got an email on 14 January, announcing Moola would close on 27 February, and asking me to cash in my investments. No panic – I haven’t lost any money, it’s all been paid back into my bank account.

Prophetically, I did warn in my post explaining ‘what are robo advisers?‘ that some were bound to disappear:

So one down, two robo advisers to go, and I can only bring you two year results for my Nutmeg and Wealthify accounts compared to Vanguard.

So one down, two robo advisers to go, and I can only bring you two year results for my Nutmeg and Wealthify accounts compared to Vanguard.

Starting point in March 2018

A quick recap.

Back in 2018, I took advantage of cashback offers when opening accounts with Nutmeg, Wealthify and Moola (RIP). Companies regularly offer tempting cashback in March, to lure investors keen to use their Isa allowances before the tax year ends on April 5.

CASHBACK CAVEAT: I would never suggest investing large amounts just based on cashback. I’ve said it before and I’ll say it again: get investment decisions wrong, and any cashback could be eaten up in poor performance and expensive charges.

But as I was investing anyway, I claimed the extra cash.

I already had an ISA for 2017/18, so I opened general investment accounts instead. Each offer had different small print about how much to invest and for how long. In practice, I jumped over the hoops by investing £1,000 in each and setting up a direct debit to pay £100 a month into the Nutmeg account.

Since then, I’ve raked in a total of £350 in cashback, reinvested in each of the accounts:

- £100 from Moola, added to my account within a week

- £50 from Wealthify, supposedly after six months, in practice (after prodding) added after 10 months on 29 January 2019

- £200 from Nutmeg, supposedly after thirteen months, in practice (after prodding) added a month later on 16 May 2019

Main takeaway: if you do use a cashback offer, note in your diary to check it actually gets paid, and contact the company if it doesn’t!

As I was investing for a good 10 years, I chose racy options. I went for the highest risk ‘Adventurous’ options for Moola and Wealthify and level 9 of 10 for Nutmeg. For comparison, I picked the Vanguard LifeStrategy 80% fund, as the nearest split of shares and bonds.

Of course, many would prefer a more measured, less risky approach – my approach won’t be right for everyone!

Comparing robo adviser options

The companies have been busy since last year’s comparison table.

Fees have ticked down slightly. Nutmeg has slashed minimum investments and now offers a Junior Isa. Wealthify and Vanguard have both launched pensions. Wealthify has ditched Wealthify Circles, which used to offer a fee discount when referring friends.

Here’s how my choices now stack up when investing £1000 in an Isa or general investment account:

| Company | Nutmeg | Wealthify | Vanguard LifeStrategy range |

|---|---|---|---|

| Started | 2011 | 2016 | 1975 as a company, 2011 for LifeStrategy |

| Different risk levels | 10 | 5: Cautious, Tentative, Confident, Ambitious, Adventurous | 5: LifeStrategy 20%, 40%, 60%, 80%, 100% |

| Risk level I chose | 9 | Adventurous | LifeStrategy 80% |

| Typical % of equities in my choice | 90% | 74% equities but 90% overall high risk | 80% |

| Minimum lump sum* | £500 | £1 | £500 |

| Minimum monthly investment* | No minimum on top of £500 lump sum | No minimum | £100 |

| Total annual fees** on £1,000 | 1% fully managed up to £100,000 (0.68% for fixed allocation) | 0.82% | 0.41% |

| Products | 5: Isa, General Investment Account, Junior Isa, Lisa, Pension | 4: Isa, General Investment Account, Junior Isa, Pension | 4: Isa, General Account, Junior Isa, Pension |

**Total annual fees includes fees for the account, for the funds and for transaction costs/market spread

Note: All companies offer ethical or socially responsible investment alternatives, typically with higher fees, but I just went for standard versions.

After one year in March 2019: bright!

By the end of the first year, I’d invested £5,200 across four different companies, including the £100 a month payments to Nutmeg.

Despite a few wobbles along the way, I emerged after a year with £150 in cashback plus another £241.77 in investment growth.

The growth wasn’t mind-blowing but just by opening the accounts and staying invested, I was up £391.77. Sweet.

I’d never have earned anything near 7.5% by leaving my money languishing in a savings account.

What could possibly go wrong??

After two years in March 2020: bleak!

Up until about a month ago, everything was ticking over nicely during the second year.

The £200 Nutmeg cashback was credited in May 2019 (thank you) and my £100-a-month direct debits continued.

My Vanguard and Wealthify balances were drifting upwards.

Moola may have shut up shop in February 2020, but by the time I transferred my money out on 21 January, my initial £1,000 investment had been boosted by £100 cashback and £203.46 investment growth, so I ended up with £1,303.46. Excellent.

Then – kaboom! – coronavirus hit. COVID-19 hurled global stockmarkets into a deep dive, taking my investment growth and cashback with it.

Example cliff, for my investments to fall off

Robo adviser results after two years

When I checked my balances after two years, on 21 March 2020, the picture was not pretty.

My Nutmeg balance was less than the money I’d paid in.

My Vanguard balance was less than I’d paid in.

The only reason my Wealthify balance wasn’t less than I’d paid in was because the losses hadn’t entirely eaten away my original £50 cashback and a more recent £50 refer-a-friend bonus.

You know all those investment caveats about ‘past performance is no guarantee of future returns, and you could get back less than you started with’? Yeah, that.

Here are the stark results after two years:

| Company | Risk level | Year 1 18/19 | Year 2 19/20 | All time 18/20 | |||

|---|---|---|---|---|---|---|---|

| Growth (%) | Growth (£) | Growth (%) | Growth (£) | Growth (%) | Growth (£) | ||

| Vanguard | LifeStrategy 80% | 7.39% | £74 | -11.9% | -£128 | -5.41% | -£54 |

| Wealthify | Adventurous | 4.14% | £43 | -12.7% | -£142 | -8.48% | -£91 |

| Nutmeg | 9 of 10 | 3.4% | £56 | -17.9% | -£675 | -15.12% | -£619 |

Note: the percentage growth is time weighted return. That just means it shows how much the investments actually grew, regardless of any cash added or withdrawn, in my case the cashback and referral bonus from Wealthify, and the cashback and extra £100 a month paid into Nutmeg.

That’s why Nutmeg shows such large changes in pounds – they are generated from a much bigger amount of money.

So my Vanguard LifeStrategy 80% investment grew most in the first year, and lost the least afterwards, with Wealthify not far behind when markets were falling.

Meanwhile Nutmeg grew less than half as much as Vanguard originally, and over two years has fallen nearly three times further: -5.41% for Vanguard and -15.12% for Nutmeg.

Depressing screen grabs after two years

Here are the screen grabs from my accounts, showing how they’ve done over two years. Note the balances rising slowly, and then falling off a cliff!

I checked on 21 March 2020, but as that was a Saturday when markets are closed, the balances actually reflect the closing value from Friday 20 March.

Vanguard: -£54.13 & -5.41%. investment growth, £1,000 contribution

Nutmeg: -£619 & -15.12% investment growth, £3,600 contributions & cashback

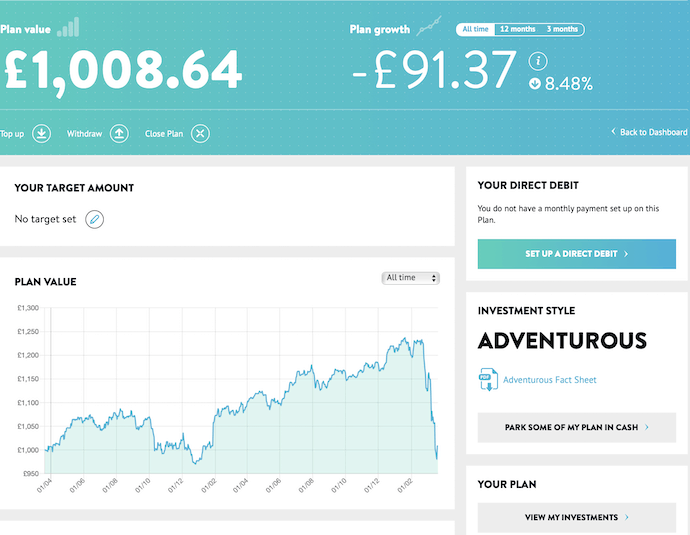

Wealthify: -£91.37 & -8.48% investment growth, £1,100 contributions & cashback

How do these robo adviser results compare to other wealth managers?

As last year, I turned to the Asset Risk Consultants (ARC) indices to find out how badly everyone else was doing.

These indices work out average returns after fees for customers of the big wealth managers, including Barclays Wealth, Coutts & Co, UBS, JP Morgan Private Bank and Rathbones.

There are four ARC indices, and my investments fall in the highest risk category: ARC’s ‘Equity Risk’. Currently my investments have very similar proportions of equities (aka shares in companies, the risky bit that drives growth but can also fall furthest): 80% for Vanguard, 81% for Nutmeg and 83% for Wealthify.

The low cost robo advisers should look good when comparing results after fees, given you’d expect the other ARC companies to be charging an arm and a leg.

In practice, for that range of equities, ARC’s Equity Risk portfolios were down on average between -7% and -14.1% in the two years to 21 March 2020.

So it looks like Vanguard did better than average (-5.41%), Wealthify was at the better end of the range (-8.48%), and Nutmeg did worse than average (-15.12%)

Compare your own investments here, then go to the ‘QuickCheck’ menu and select ‘Performance’, click ‘£’ and follow the instructions on screen. Tick ‘I have daily data’ if you want to compare specific dates rather than months.

So what?

Thanks to COVID-19, my battle of the robo advisers has suddenly become more dramatic than expected!

Overall, across the three companies left, I’ve invested £5,400 including the Nutmeg monthly payments.

After a bruising end to the second year, my balances had dropped to just over £4,935.

That’s down £465 of my own money, but it’s actually more painful than that.

Remember how I had to close my Moola account on 21 January? I checked my other accounts at the same time, which was pretty much the peak of the market.

Back then, I was looking at investment growth with Vanguard of £203 (20%), with Wealthify of £187 (18%) and with Nutmeg, from the bigger investment, of £368 (13.5%).

So in the two short months since, coronavirus has scorched through more than £1,500 in investment growth, cashback, a couple of Nutmeg monthly payments and a Wealthify referral bonus.

*and breathe*

The good news is that the losses only exist on screen. I would only actually lose money if I sold now, rather than gritting my teeth, staying put and waiting for prices to climb back higher than I paid. Thankfully, I’m investing for a good 10 years. I don’t have a crystal ball, but I reckon my balances will look a damn sight better by then, even if right now things could well fall further, and be slooooow to recover.

Yes, markets have bombed. It happens.

If you want a piece of the higher long term returns historically offered by the stock market, you have to accept that markets can, and do, drop. That’s why it’s vital to only invest money you can leave untouched for at least five years and ideally longer, so you can hang tight until markets pick up again.

If you do want to choose between investment websites, bear in mind that this comparison is only over two years, which is a really short time when investing. The robo advisers also offer different combinations of investments for different risk levels. I went for the risky end, in the hope of coining it in good times. A more cautious approach should fall less in troubled times. If seeing losses will stop you sleeping at night, steer clear. Markets have plunged, but there’s no guarantee they won’t fall further.

So rounding out an eventful second year, I still wish Nutmeg had done better.

It’s still the biggest, most established robo adviser, with the most informative website, biggest range of products and most efficient payment processing, and the only one regulated to give simplified advice.

However, Nutmeg still has the highest fees in this comparison, and dropped further than my other investments.

Wealthify was a decent runner up in a falling market.

But I remain impressed that Vanguard, with the lowest charges using a LifeStrategy fund, fell less than my robo adviser accounts while everything was tumbling off a cliff. The website is less fancy. There’s no questionnaire to guide your choice. It doesn’t offer cashback bribes. But it remains one of the biggest investment companies in the world, which I find a comfort when markets are so rocky. Moola has already shut up shop. In these troubled times, which robo adviser might be next?

Cashback

If you are still interested in cash back, here’s what’s available in April 2020.

I will merely note that the company offering the highest cashback has performed worst for me, and the company offering zip all cashback did best.

New Nutmeg customers: £110 via Quidco or £105 via TopCashback. That’s a better deal than using my referral link, where I get £100 but you only get 6 months without Nutmeg fees.

New Wealthify customers: £80 cashback via TopCashback, £50 cashback via Quidco and only £25 each via my referral link.

Now – over to you. What’s your experience with robo advisers? Have you dared check your balance recently? If you’ve never invested, are you considering taking the plunge this tax year, or preferring to stay well away? Do share in the comments, I’d love to hear!

Disclosure: No-one has paid me to write this post, although I have written collaborative posts with Vanguard in the past.

Hmm. I need to look at my own figures a little more carefully, so I’m not going to comment on them just yet. You seem to be comparing apples with oranges, though. The Wealthify and Vanguard figures are based on lump-sum investments two years ago, whereas the Nutmeg figures are based on drip-fed payments. Could you perhaps unitise each pot and then compare the value of each unit, rather than looking at the headline loss?

Author

Thanks for commenting!

Completely right that I only continued with regular payments with Nutmeg, after the initial lump sum investments in all three. Suggest any comparison should stick with the time-weighted returns (ie the percentages), which strip out the affect of any withdrawals or subsequent contributions.

As I say in the post, the pound loss is a bigger figure with Nutmeg because it was based on a larger sum invested. I included the combined headline loss to highlight the very real risks of investing in the stockmarket.

It’s the *percentage* loss that I’m criticising though. Has your Nutmeg account suffered more because of their fee structure, or because of their asset allocation, or because of the fluctuating buying power of your £100 each month?

At least you dodged a bullet with the fortunate timing of when Moola forced you to cash in investments !

Very helpful!

I just opened a Wealthify account at the end of Feb 2020 so haven’t had great initial results.

However, pleased with their constant communication throughout the past 5weeks and rebalancing of my account.

Great article, thanks very much for taking the time to write this post. It has helped me in my thinking about which platform to use for my upcoming stocks and shares ISA. I had narrowed it down to the ones you have compared!

Great articles, thanks for the info.

I think though that March/April were so volatile that wouldn’t be very representative for the comparison, although it shows how they coped with losses. It’d be great to analyse it now (June) and see how their response to the COVID-19 shock was.

Author

Hi Ramon – You said it, March and April were definitely volatile!

If it helps, my balances today (9 June 2020) are:

Vanguard: £1,159.12 on £1,000 invested, so all time growth of £159.12 and 15.91%, and up £63.75 and 5.82% over the last year

Wealthify: £1,231.25 on £1,100 invested and cash back, so all time growth of £131.25 and 11.72%, and up £70.59 and 5.58% over the last year

Nutmeg: £3725 on £3,600 invested and cash back, so all time growth of 6.36% and £125. Nutmeg only provides growth rates for all time, not for shorter periods, so I don’t have official figures for the last year. However, my investments are £71 up over the last year, on top of the £100 a month I was still investing until March. So up a similar amount over the last year to Wealthify but earned on a much bigger investment, so will be a distinctly lower growth rate. I had a go at calculating the time-weighted rate of return for the last year and came out with 2.3%.

Hey, great post, I’m looking to start using Vanguard from reading your blog and many others, but thinking is this the best time to start as fund\share prices should be lower now?

Author

Hi Maj,

One financial advisor I know always says the best time to invest is when you have the money – ie don’t try and time the market.

Investing is a long term thing, rather than a get rich quick strategy, where what matters most is the length of time you can stash away your money, rather than exactly when you start.

That said, although markets have bounced back since low points at the end of March, generally they are still well below the peaks at the start of the year. So could be a great time to pick up more for your money – although brace yourself for a rocky road ahead!

Hi – I just came across this and wanted to suggest you might want to update your screengrabs for Nutmeg. I stuck with them after March and they have bounced right back!

Ah, apologies sorry I see this in a different reply

Author

No worries Rachel, glad you found the info you were looking for! I’m intending to publish a new post showing three year performance, fingers crossed it’s better than March 2020…

Glad your Nutmeg balance also bounced back after March. Investing is a long term game, and if you can hold your nerve when markets fall, prices normally do come back up in time.

thanks for the post

I opened a Nutmeg account one year ago. Very unfortunate timing but I’m still impressed that after the crash in March it’s now up 7%. Can’t believe in my later years I’ve only just dared to move away from savings accounts.

Author

Congrats on making the leap! Glad you’ve had a good experience so far, despite the big dip in the stockmarket last year. It’s so frustrating when interest rates are so low. I hope your investments continue to do well.

be good to see a year on have things recovered?

Author

Absolutely David! I have post in progress to update on year three. It’s certainly been a rollercoaster since 2018…

I shall look forward to seeing that :D. I have just paddled into the investment shallows as of this week and I have dropped my eggs in the Vanguard baskets at the moment. Given that the rumour mill is talking up a stock market crash we shall keep our hopes up that Vanguard will weather the storm!

I am so happy investing with TD Ameritrade.. He has really helped after I lost my job. I started investing as little as $200 and now I earn over $2,500 weekly. So happy you can contact him on his Email: tdameritrade077@gmail.com

Via whatsapp: (+12166263236)

Thanx for sharing amazing blog

Hello, Thanks for sharing helpful information with us. It really helped me. I always prefer to read quality content, which I found in your post. thanks for sharing with us..

I just want to say Thank You to everyone who supported me through the years. My name is Manuel Franco, New Berlin, Wisconsin. My story of how I won the Powerball lottery of $768.4M is a bit of a tale. I have been playing Powerball tickets for 6 years now since I turned 18. I bought my first ticket on my 18 birthday. I was feeling very lucky that day because I had contacted Dr. Odunga Michael to help me with the winning Powerball numbers. I really had that great great feeling that I looked at the camera wanting to wink at it. I only did a tiny part of it and trusted him. He gave me the numbers after I played a couple other tickets along with it for $10. I checked my ticket after the winnings came online and saw the numbers were correct including the Power play. I screamed for about 10 minutes because it felt like a dream. I had won $768.4M. You can check my winning testimony with the lottery officials just with my name search. Thank you Dr Odunga. Well, his email is odungaspelltemple@gmail.com and you can also call or Whats-app him at +2348167159012 so you guys can contact him

BE SMART AND BECOME RICH IN LESS THAN 3DAYS….It all depends on how fast

you can be to get the new PROGRAMMED blank ATM card that is capable of

hacking into any ATM machine,anywhere in the world. I got to know about

this BLANK ATM CARD when I was searching for job online about a month

ago..It has really changed my life for good and now I can say I’m rich and

I can never be poor again. The least money I get in a day with it is about

$50,000.(fifty thousand USD) Every now and then I keeping pumping money

into my account. Though is illegal,there is no risk of being caught

,because it has been programmed in such a way that it is not traceable,it

also has a technique that makes it impossible for the CCTVs to detect

you..For details on how to get yours today, email the hackers on : (

atmmachinehackers1@gmail.com < Tell your

loved once too, and start to live large. That's the simple testimony of how

my life changed for good…Love you all .