Which fund to pick?

So you want to invest in the stock market – now what?

Trouble is, if you’ve never invested before, it can be hard knowing what on earth to pick. This post is about a simple low cost option that can get you started: Vanguard LifeStrategy.

You might be all fired up, after deciding investing is right for you. You’ve got some money you can set aside for at least five years, and ideally longer. You don’t just want to stick it in a savings account, where the value will be eaten away by inflation. You’ve braced yourself to risk the stock market, in the hope of higher returns. You’re well aware that your balance might go down, not just up.

Previous post: Are you ready to invest?

But choosing where you’re actually going to invest can seem overwhelming.

There are thousands of different shares and funds out there, from hundreds of different firms. The names have so many random letters (OIECs? ETFs? Eq? Acc? Inc?) it looks like the companies just shook up a Boggle board.

Certainly, I’ve been writing about investing for years and I still worry about making the wrong choices.

Experienced investors always advise newbies to “do their own research”. That’s all well and good.

But hello? Not everyone wants to swot up on financials, decipher the jargon and geek out about investing (or can afford an adviser to do it for them).

Here’s the thing: you really don’t have to learn investing inside out to get started.

And – even better – you don’t have to do it all the yourself, but can use a single fund to do it for you.

Spread your money all over the shop

Investment basics

If you learn one thing about investing, remember this:

It’s sensible to spread your money across lots of different companies, countries and types of investment, not just bung your life savings into a single share or crypto currency. Want to sound like you know what you’re talking about? It’s called ‘diversification’.

Let’s face it, if the British economy is going to hell in a Brexit handbasket, it makes sense to spread your money further afield.

The right mix for you depends on whether you’re keen to take lots of risk, in the hope of earning extra, and accept that your balance might plummet. If that would keep you awake at night, opt for a mix where you might see smaller losses if stock markets fall, but smaller gains if they rise. There’s no ‘best’ choice. Not everyone wants the fieriest curry on the menu, some are happy to stick at the korma end of the scale.

But whatever mix you choose, you’ll need to keep an eye on it in future. If some parts do super well compared to others, you may need to sell stuff and buy other stuff to return to roughly the same risk. Technical term? Rebalancing.

Now, you could research all the different investments, pick and choose your own combination, and get round to rebalancing. Happy to do that? Knock yourself out.

But if you just want to start somewhere, you could choose one fund that does it all for you.

Sit back and let Vanguard do the hard work

Simple solution: Vanguard LifeStrategy

Personally, I’m a big fan of the LifeStrategy range of funds from Vanguard, because they offer a super simple one stop shop.

I like them because they are (deep breath please) ‘low cost globally diversified multi asset funds with automatic rebalancing’.

That may make as much sense as a chocolate teapot, but in practice it means that Vanguard does all the hard work.

They choose all the investments to spread your money across the world, take care of tweaking to keep the same mix, and do it all for peanuts.

As a money-saving blogger, I’m delighted that the LifeStrategy range is so low cost.

The funds charge just 0.22% a year. That’s just 22p for every £100 invested. Buy LifeStrategy direct from Vanguard, by opening an account with Vanguard Personal Investor, and you’ll only pay another 0.15% a year to hold the investments. That adds up to a tiny 0.37% in total, so it would only cost 37p to invest £100 for a year. It’s less than half the 1% or so you’d expect to pay using a new-fangled robo adviser.

(And yes, you could pay even less if you picked your own super cheap tracker funds, but you’d have to do all the choosing and rebalancing yourself. I don’t mind paying 0.07% or so a year for that)

Plus Vanguard is one of the biggest asset managers on the planet, not some start up that might disappear if its funding runs out.

Vanguard keeps costs low partly because it’s massive, and partly because the LifeStrategy funds are based on ‘tracker’ funds, also known as passive funds or index funds.

Tracker funds aim to match or ‘track’ the performance of a particular index, like the FTSE 100 index of Britain’s biggest companies. Typically, tracker funds cost less because they can be run by a computer, unlike actively-managed funds which pay a fund manager to pick and choose between investments, trying to beat the market. Active fund managers argue that you pay extra for better performance. Tracker funds argue that the active managers don’t always deliver better performance, so you might as well just try and match the market. I reckon there’s a role for both, so I’m going to leave the active vs passive debate for another day. But the big pro for tracker funds is that they are cheap, which means costs won’t gouge so much of your money long term.

What are the different Vanguard LifeStrategy funds?

The LifeStrategy range includes 5 different funds, which mix racy equities (jargon for shares in companies) with more staid bonds, which are loans to companies or governments.:

- Vanguard LifeStrategy 20% equity fund, which is 20% equities and 80% bonds

- Vanguard LifeStrategy 40% equity fund, which is 40% equities and 60% bonds

- Vanguard LifeStrategy 60% equity fund, which is (you’ve guessed it) 60% equities and 40% bonds

- Vanguard LifeStrategy 80% equity fund, which is, yes, 80% equities and 20% bonds

- Vanguard LifeStrategy 100% equity fund, a full on 100% equities

But you don’t just get one one bond fund and one equity fund, in different proportions. Oh no.

Each of the LifeStrategy funds invests in a whole bunch of different Vanguard tracker funds, which in turn reflect the performance of thousands of different individual investments.

So for example, Vanguard LifeStrategy 80% contains 13 funds investing in more than 18,240 holdings, as at the end of September.

Find out more about LifeStrategy funds

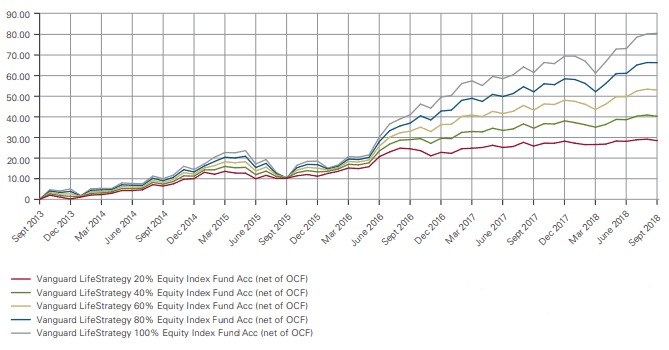

How LifeStrategy funds did over the last five years

Show me the money

All the theory is fine, but what’s really important is whether your investments make money. Past performance is no guarantee investments will do as well (or as badly) in future, but it’s worth looking at.

So how have the LifeStrategy funds done?

Looking at the graph above, you can see that the bigger the percentage of equities, the more the LifeStrategy fund grew – but also the more wobbly the ride!

You can check out performance figures on the Vanguard website, but if you zipped back in a Tardis to invest £1,000 five years ago, you’d now have:

- Vanguard LifeStrategy 20%: £1,255

- Vanguard LifeStrategy 40%: £1,347

- Vanguard LifeStrategy 60%: £1,445

- Vanguard LifeStrategy 80%: £1,544

- Vanguard LifeStrategy 100%: £1,649

(Figures as of end Nov 2018)

That’s way better than stuck in a savings account!

Bear in mind that investments don’t churn out the same results, year after year, unlike a savings account. Funds might grow masses one year, hardly anything another year, and even dip down in certain years. For example, the graph below for Vanguard LifeStrategy 80% shows the performance each year for the last five years:

Expect different results every year!

Compared to similar funds, LifeStrategy may not zoom straight to the top of the tables, but the 20%, 40%, 60% and 80% versions are soldily in the top quarter.

Don’t take just take my word for it about LifeStrategy.

Morningstar, the investment performance number crunchers, give the LifeStrategy 20%, 40%, 60% and 80% versions a big fat ‘Gold’ award. Trustnet, another investment info website, gives LifeStrategy 20%, 40% and 80% the maximum five gold crowns, with four crowns for LifeStrategy 60% and three for LifeStrategy 100%.

Which to choose?

Which LifeStrategy fund is right for me?

Basically your choice will depend on two things:

- how comfortable you are with risk, ie can you stomach seeing your balance shoot up and down?

- how long you are investing for.

Equities tend to be more risky than staid and sensible bonds, so money invested in equities can peak higher and plunge lower. The higher the percentage of equities, the more chance your investments will be a roller coaster ride.

Happy to take the risk in the hope of making loads of moolah? Stashing money away for retirement in 40+ years time? Opt for a high percentage in equities, knowing you’ve got time for your investments to recover if markets fall.

Feeling cautious? Might need your money in only a few years time? Stick with a smaller percentage.

If it’s remotely helpful, Vanguard describes LifeStrategy 20% as suitable for ‘cautious’ investors, LifeStrategy 40% and 60% for ‘moderate’ investors and LifeStrategy 80% and 100% for ‘aggressive’ investors.

Just remember that like any stockmarket investment, you might get back less money than you started with, if you sell out after prices have fallen, rather than waiting for prices to pick up. Even if you stick to a measly 20% equities, that doesn’t mean your balance won’t drop.

Personally, when I first invested with Vanguard, I went in all guns blazing. I went straight for LifeStrategy 100%, knowing I had a good cash cushion in my emergency fund and was investing for retirement several decades away. More recently, I stocked up on LifeStrategy 80% instead, to get the benefit of a smoother ride and rebalancing with 20% bonds.

However, if you’re just hoping to earn a bit more than you might get in a savings account, and can’t afford to lose a big chunk, for example if you’re inching towards a house deposit, or nursing your nest egg after retirement, you might go as low as LifeStrategy 20%.

For more on attitudes to risk, and the upside of return, check out this post by Mrs Mummypenny

Ready to take the plunge?

Tips on taking the plunge

Chosen your fund? Hop over and get started!

Couple of tips:

- You don’t need millions of pounds to start investing. Some websites accept as little as £1. The Vanguard account I use can be opened with £500 as a single payment, or you can pay in from £100 a month.

- Take advantage of tax breaks. If you use an Isa (individual savings account) rather than a general investment account, your investments will grow without the tax man taking a cut. Vanguard doesn’t offer a pension yet, but are promising to launch one next year.

If you get a taste for investing, you might want to do more research and add different investments in future. For example, as your balance grows, you might want to add funds in areas that aren’t covered by LifeStrategy, such as smaller companies, property or commodities.

But if you just want to get started, LifeStrategy is a great option. Once you’ve chosen one of the five funds with the right risk for you, you can just set up a direct debit to bung in money each month, then sit back and let your investment take care of itself. Job done.

Join our twitter chat!

Got any questions? Do join me on a Twitter chat towards the end of January. I’ll be talking investing with fellow money blogger Lynn from Mrs Mummypenny and Vanguard. Follow me on Twitter at @MuchMore_Less for news on the date and time, and use the hashtag #StartInvesting for any queries. Whether you’re a LifeStrategy fan or like choosing your own portfolio, learn more about how investing can help make the most of your money!

Now – over to you. If you’ve ever invested, what did you start with? And if you want to start, but haven’t taken the plunge, what’s stopping you?

This post was written in partnership with Vanguard, but the views are my own. I really am a big fan of the LifeStrategy funds!

Pin for later:

Great post with a very simple explanation of which level of risk might be right for you. I am in the process of moving my boys Junior ISA’s over to Vanguard, am looking forward to choosing a fund for them.

Author

Good luck choosing funds for your boys! If you’re putting money in Junior Isas until they’re 18, that’s definitely long enough to benefit from investing, rather than just sticking with a savings account.

Great post Faith. Have you looked into Vanguard’s Global All Cap Index Fund? It’s a good alternative to the 100% equity LifeStrategy fund. Vanguard themselves say a global market cap approach is best. More specifically, they overweight domestic holidings (UK companies) in their lifestrategy funds. And they do this because investors have a tendency for home bias (overweighting in domestic stocks). They’ve gradually reduced the home bias over the years but it’s stull substantial in LifeStrategy.

Thanks Andrew! Appreciate LifeStrategy funds have a greater chunk in UK markets than the UK represents on the global stage, unlike Vanguard’s FTSE Global All Cap index fund, and I’m fine with that. Think for me one of the big attractions of LifeStrategy is the combination of equities and bonds in a single fund, and the rebalancing in future, so that’s why I’m veering more towards LifeStrategy 80% than 100% equity alternatives.

Great Post

I was just wondering if you would invest in the different LifeStrategy funds?

For example – retirement cash in 20/80 (where 80 equals bonds) and left over end of month money in 80/20 (where 20 equals bonds)

Many thanks

MB

Author

Hi Martin –

You certainly could invest in more than one different LifeStrategy funds if you wanted.

The range comes with options for 20%, 40%, 60%, 80% and 100% equities, and I have some money in 80% and some in 100%.

If you wanted a different split between equities and bonds, you could combine a couple of funds to create it. However, if you want to maintain the same split in future, you’d probably have to tweak the balance over the years, selling some of one and buying a bit more of the other, as it’s unlikely both funds will grow at exactly the same rate.

Part of the attraction of LifeStrategy for me is that I don’t have to worry about rebalancing because the funds do it for me!

All the best

Faith

Very useful article, thanks. Does investing in multiple Lifestrategy funds mean you’re increasing the fees you’re going to pay?

Author

Hi Ali –

The amount of fees will depend on the amount invested, rather than the number of LifeStrategy funds. So £1,000 in one LifeStrategy fund would have the same annual fees as £1,000 split £200 each between the five LifeStrategy funds. That said, looking at Vanguard’s charges sheet, may find small differences in transaction costs between different LifeStrategy funds, max 0.03 percentage points a year.

(Link: https://www.vanguardinvestor.co.uk/content/documents/legal/vanguard-full-fund-costs-and-charges.pdf)

When I buy funds on Vanguard Personal Investor I don’t pay dealing fees each time either, so therefore no difference if I buy one fund or 10.

That’s great, thanks.

Hi Faith

I found your article really useful; thank you. Being new to investing, I think one of the LifeStrategy Funds will be suitable as I need it to be easy. I had a couple of questions:

– I read that the LifeStrategy Funds are weighted more towards UK firms. I know people have different opinions about the economic effects of Brexit, but personally I have little doubt the effect will be negative. With the end of the Brexit transition period approaching I was a bit concerned – in terms of investing right now in autumn 2020 – about the UK weighting in the LifeStrategy Funds. Do you think that would be a reason to go for a different kind of fund?

– More generally, I know they say you shouldn’t try to ‘time the market’ – and the principal reason I’m looking at investing now is because we have the money come available now – but I’m a complete newbie, so sorry if this is a daft question: Is it a particularly risky time to invest with all the Covid & Brexit uncertainty?

Perhaps I should say that we’re looking to invest for about 6-10 years, hopefully to build cash towards a house purchase. It’s also possible we’d leave the investment in longer-term than that.

Thanks, Ben

I’m not sure even a financial expert could answer that with any confidence. There are all-world funds that might be better if you’re worried about leaning too heavily towards the UK.

Does anyone know if Vanguard charge a fee if you need to withdraw money from a Lifestrategy fund? I’ve had a look on their site and it’s not obvious if they do or not.

Hi Gordon,

There are no fees, I will attach a link for you to verify.

https://www.vanguardinvestor.co.uk/what-we-offer/fees-explained

I just want to say Thank You to everyone who supported me through the years. My name is Manuel Franco, New Berlin, Wisconsin. My story of how I won the Powerball lottery of $768.4M is a bit of a tale. I have been playing Powerball tickets for 6 years now since I turned 18. I bought my first ticket on my 18 birthday. I was feeling very lucky that day because I had contacted Dr. Odunga Michael to help me with the winning Powerball numbers. I really had that great great feeling that I looked at the camera wanting to wink at it. I only did a tiny part of it and trusted him. He gave me the numbers after I played a couple other tickets along with it for $10. I checked my ticket after the winnings came online and saw the numbers were correct including the Power play. I screamed for about 10 minutes because it felt like a dream. I had won $768.4M. You can check my winning testimony with the lottery officials just with my name search. Thank you Dr Odunga. Well, his email is odungaspelltemple@gmail.com and you can also call or Whats-app him at +2348167159012 so you guys can contact him