Save on breakdown cover before you get stuck

If you are a driver, you can save loads on breakdown cover – as long as you don’t let it auto renew!

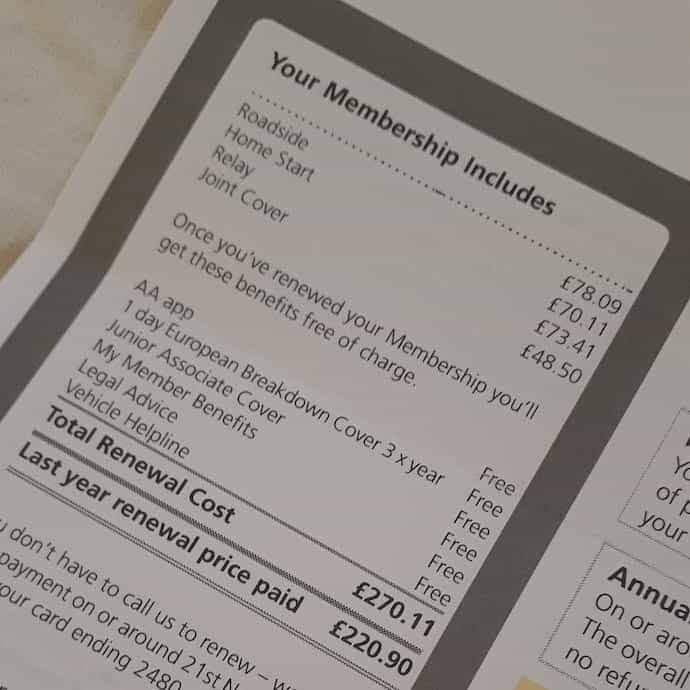

This post is based on a frugal fail. Last year, I got stung when I didn’t get round to sorting our cover before it renewed automatically. Our AA membership shot up from £109 as a new customer to £220. Ouch. I resented paying double the price.

This year they wanted more – £270! That’s an increase of almost another 25%!

I really didn’t want to pay over the odds again, so I tackled it yesterday morning.

After checking quotes, cashback and a quick call to the AA, I ended up switching to the RAC. Our new premium cost £109 and I should get 11% cashback, just by clicking through from TopCashback before purchasing the policy. This brings the cost down to just under £97.

I reckon spending half an hour to save £173, compared to the renewal quote, is well worth doing.

Here are my top tips if you want to save on breakdown cover.

Pin for later:

This post may contain affiliate links, so anything you buy through it will help support the blog, as I will get a small commission at no cost to you. Many thanks!

Painful price of auto renewing

Table of Contents

Don’t auto renew

Don’t ignore your renewal letter! Check the new cost and when it’s due, then carve out time to cut it.

The company might sound like they’re doing you a favour, continuing your cover without you having to a lift a finger. But you’ll pay an awful lot for the convenience.

Check if you’ve already got cover

I’m not suggesting you might have bought breakdown cover in your sleep.

But do you already have cover, for example if you pay a monthly fee for a current account?

Some packaged current accounts such as Nationwide FlexPlus, Halifax Ultimate Reward and Co-op Everyday Extra offer a bundle of benefits including breakdown cover. No point paying twice!

Compare prices

Before calling the company (‘you want to put it up by HOW MUCH???‘), arm yourself with the relevant info.

It doesn’t have to be a major hassle. I popped over to two websites, the AA and RAC, to see how much new customers pay for the same cover. RAC quoted £108.51 and the AA £169.01 for a year’s cover. I’m sure there are other great options out there, but I focused on the big hitters to make life easier.

Weigh up your cover

There are various twiddly bits that make up breakdown cover. The more you add, the higher the premium, so choosing less cover will cut your costs.

UK vs Europe?

Where will you be driving? We opt for cheaper UK cover as we rarely drive in Europe.

Vehicle vs personal?

Do you want to cover you or the car? Vehicle cover applies to a specific car, no matter who’s driving. Personal cover applies to the individual, no matter which car you’re driving, or even if you’re a passenger in someone else’s car.

Vehicle cover tends to be cheaper, but we go for personal cover, as we have two cars and sometimes borrow a bigger car to go on holiday.

Individual or as a couple?

If you’re a couple, it’s usually cheaper to buy breakdown cover for both people at the same time, rather than two single policies.

What’s covered?

Personally, we go for:

- roadside assistance, to avoid being stuck by the side of a motorway

- the bit about towing your car if it can’t be sorted on the spot

- home start, in case our cars die in the drive

But no, I reckon we don’t need to pay extra for getting keys cut, legal expenses, a contribution towards repair costs or money for transport and accommodation after a breakdown while away from home. We have some emergency savings if needed.

Previous post: Where do you stash your emergency cash?

Annual vs monthly?

If you can afford to fork out for a full year’s cover, it’s usually cheaper than the total from paying each month.

Check cashback

Always check cashback websites like TopCashback* and Quidco before buying breakdown cover – the discounts can be super generous.

Yesterday, TopCashback was offering 11% cashback on RAC* UK personal breakdown policies and a generous 33% on vehicle based policies. That’s a healthy chunk of cashback.

Meanwhile you could get a whopping 42% cashback on AA* UK breakdown cover.

Quidco offered slightly less – 30% cashback on RAC UK vehicle breakdown policies, 10% on RAC’s personal version, and 40% on AA UK breakdown cover.

After setting the TopCashback rates against my quotes, the cost of breakdown cover for new customers dropped to £96.57 at the RAC and £98.03 with the AA.

Cashback isn’t guaranteed, but it usually does work out, and can be well worth it. The sites are free and all you have to is click through from them before buying online elsewhere!

Give ’em a call

Give your current company a call

I reckon it’s worth a quick call before switching elsewhere, to see if your current company can offer a better deal.

Previous post: Broadband: how to save without switching

So I rang the AA, pressed the buttons for the renewal option, and pointed out our renewal price was a lot higher than last year.

The nice man on the phone promptly offered to cut the cost to £224, pretty much what we paid last year, and to freeze for next year. Saving £46 a year compared to our renewal quote might have sounded quite good, if I hadn’t checked the premiums for new customers elsewhere.

Having the numbers for quotes and cashback to hand, and explaining politely that you can get cover cheaper elsewhere, works wonders.

I was then offered £202.58, again frozen for two years. So £67 off the renewal quote just for a few minutes chat.

Once it was clear I really was thinking of switching, the final offer was £169.01 for one year. That’s a hundred pounds lower than our renewal letter, and the same as the premium for brand new customers. However, the guy on the phone couldn’t match the cash back, so I cancelled the policy when it runs out.

Be prepared to switch

Buying a new policy from the RAC only took a few minutes.

I clicked through from the relevant RAC page on TopCashback, ticked the cover I’d already looked at, filled in a few personal details, and set the new breakdown cover to start when our current policy stops.

At £108.51 the policy is already way lower than our renewal quote, even if the cashback doesn’t come through.

Name the first driver

One admin point: with joint cover, put the person who usually deals with money matters as the first named driver.

With our AA policy, I had to hand the phone to my husband to finally cancel the cover, as he was the first named driver. With the new policy, I’ve put myself down as first named driver. I don’t want to risk auto renewing just because we weren’t in the same place at the same time to call the breakdown company during working hours!

Thoughts on how to save on breakdown cover

It took me max half an hour to cut the cost of our cover by £173, and I reckon that’s money well worth having.

But it worries me that such big savings are possible. Slashing £100 off premiums in a single phone call, and hefty cashback rates up to 42%, imply the original premiums have mega high margins. The two new customer quotes I got, after allowing for cashback, were surprisingly similar, with only a few pounds difference.

What about people who aren’t internet savvy, or don’t use cashback websites? Anyone who still thinks loyalty pays, or doesn’t like calling companies for a better deal? If you know anyone vulnerable or elderly, it might be worth asking if they have breakdown cover, and whether you can help cut costs.

So don’t get stung like I did last year. Never let breakdown cover auto renew – and hang on to more of your own money!

Now – over to you. Have you ever cut the cost of breakdown cover? What’s your top tip? Do share in the comments, I’d love to hear!

Hi, I’m a new reader and like your blog but you are massively overpaying here still. Autoaid are far cheaper for equivalent personal cover at £59.99 (was around £40 until earlier this year). I was with them until this price increase before I jumped ship to Startrescue where I got vehicle cover for just over £30. AA and RAC are rarely the cheapest unless you manage to happen upon a ludicrous cashback deal.

Author

Hi Peter – Thanks for the top tips about Autoaid and Startrescue, I’ll check them out! No surprise that I might still be paying too much, given the over-inflated premiums so far.

Can I ask if you’ve ever had to call either company for assistance? With insurance products and breakdown cover there’s always the fear of being let down when it comes to claim, so I’ve tended to stick with paying the price for known brands. Might yet persuade my husband to switch to someone like Green Flag next year…

Autoaid have been featured on MSE for a long time and I picked up Startrescue from HUKD. They both make use of local recovery services rather than having their own fleet, one of the reasons for the cheaper cost I believe. It used to be the case with autoaid that you paid for your own recovery and then claimed it back but I believe they ended that when they were bought out recently. Startrescue were Which recommended this year.

My wife has used autoaid for a flat before and they promptly sorted her out and got her on her way.

My husband and I have been with Autoaid for several years (now £59.99 for cover for both of us, with two elderly cars) and have found them to be pretty good. I think we’ve had to call them out three times and have been very pleased with the service each time.

Author

Hi Louise – Thanks a lot for letting me know about your experience with Autoaid, great it worked so well for a good price!

Author

Thanks Peter, that’s really helpful. Good to hear about the Which recommendation for Startrescue and your wife’s positive experience with the Autoaid call out, much appreciated.

Over the past 5 years I’ve called the AA when they send their ‘unacceptable’ price hiked renewal. My original very basic cover was £39 p.a. and each year they kept on wanting to raise it above £60 p.a. However, after a 25/30 min phone conversation each year, they relented each time. However, this year I couldn’t be bother to waste 25/30 mins of my time on the phone and simply cancelled my direct debit with my bank immediately they sent their predictable price hiked renewal notice. I didn’t advise the AA.

This time they sent numerous letters over 3 months asking me to renew my bank details for the £62 p.a. and I did not respond. However, last week they sent me a letter advising me that I can renew my old breakdown cover for . . . . £39 for the year. Whilst it’s tempting, I am sure the same old wasted 25 mins will simply resume. So, I think I’ll ignore them and try to be discipled enough to save £40 each year into my own emergency account.

As my car is only 5 years old, bought new, driven sensibly only by myself (!) and has not gone wrong yet, I am not particularly worried about some time without breakdown cover. However, I know that most people are unlikely to have this luxury, so please don’t judge me as naive or brave.

I know this is a small blog site, but it’s just what I need to express my actions and emotions. So, thank you.

Graham

Author

Hi Graham – Do sympathise with your frustration at having to do the phone call every year to keep the price at a reasonable level. Many thanks for commenting and can see why you might not want to pay for breakdown cover at all. Personally, I pay for the peace of mind, due to fear of the whole family being stuck at the side of a motorway in the middle of the night! Next year I’m keen to investigate some of the cheaper providers mentioned in the comments above, and will hope they don’t jack their prices up to quite the same extent.

Well, since November the AA have sent me 3 invitations to re-join. But now they are not only charging the original £39 but also offering a £20 M&S voucher (and I do like M&S t-shirts!). Whilst I think they are now desperate, I can’t help thinking that I’d be shooting myself in the foot by refusing this offer. I’ll mull it over for a week ot two, but I’ll probably go for it in the end! If I do go for it, I’ll let you know in 1 year what happens for the next renewal.

Author

£39 for AA membership plus a £20 M&S voucher sounds like a good deal to me too! And yes, would be great to find out how high the renewal afterwards hits, if you do take them up on it!

I just want to say Thank You to everyone who supported me through the years. My name is Manuel Franco, New Berlin, Wisconsin. My story of how I won the Powerball lottery of $768.4M is a bit of a tale. I have been playing Powerball tickets for 6 years now since I turned 18. I bought my first ticket on my 18 birthday. I was feeling very lucky that day because I had contacted Dr. Odunga Michael to help me with the winning Powerball numbers. I really had that great great feeling that I looked at the camera wanting to wink at it. I only did a tiny part of it and trusted him. He gave me the numbers after I played a couple other tickets along with it for $10. I checked my ticket after the winnings came online and saw the numbers were correct including the Power play. I screamed for about 10 minutes because it felt like a dream. I had won $768.4M. You can check my winning testimony with the lottery officials just with my name search. Thank you Dr Odunga. Well, his email is odungaspelltemple@gmail.com and you can also call or Whats-app him at +2348167159012 so you guys can contact him

The RAC is one of the worst companies I have ever had the misfortune of using

Guy on the switch board said I had to pay £40 excess on every call out when the mechanic turned up he said I didn’t that I was fully covered.

I had to call them out again and was told they wouldn’t book the job unless I paid the £40 up front asked to speak to a manager I was told I couldn’t was told I was being put through to the complaints department just sent me back to original number and has to go through the process again still wanted £40 had to pay to get assistance asked for head office number gave me same number again so no complaints department or head office if I were you I’d check to see if you will be charged as it could end up being alot more expensive than you think surffice to say I won’t renewing my policy and would strongly advise people to pay the extra and go with the AA or Greenflag because if you search on line you will see many dissatisfied customer reviews not just on the issue of the excess but also the waiting times sometimes not turning up until the following day

I Need A Hacker To Recover My Lost Investment? Go To Lost Recovery Masters

Hello guys, I’m Lyne Azabal from France. In my investment with Acstons-Cc, I also lost 17 lakhs. Trading using the Acstons. cc app generated a profit of 197,153 USD after paying tax and a 25% fee, however they would not release my profit and all of my Bitcoins were frozen. I called my pals, who suggested I try LOST RECOVERY MASTERS, and to my astonishment they were able to assist me get back 89% of my money. Despite the fact that I didn’t get all of it back, I’m still really appreciative of LOST RECOVERY MASTERS

For advice on recovering cryptocurrencies, get in touch with Lost Recovery Masters You can also ask them questions about any firm you wish to deal with.

Contact them: Whatsapp (+44(7537)-105921) Email (Support@lostrecoverymasters.com) Learn More https://lostrecoverymasters.wixsite.com/recoverbitcoin2024

This is how 30 seconds of your time can earn you a free gadget such as iPhone, Steam deck, Playstation, Laptop, iPad, etc. If that is too real to be true, then check it out here: https://survey4reward.free.nf/

BE SMART AND BECOME RICH IN LESS THAN 3DAYS….It all depends on how fast

you can be to get the new PROGRAMMED blank ATM card that is capable of

hacking into any ATM machine,anywhere in the world. I got to know about

this BLANK ATM CARD when I was searching for job online about a month

ago..It has really changed my life for good and now I can say I’m rich and

I can never be poor again. The least money I get in a day with it is about

$50,000.(fifty thousand USD) Every now and then I keeping pumping money

into my account. Though is illegal,there is no risk of being caught

,because it has been programmed in such a way that it is not traceable,it

also has a technique that makes it impossible for the CCTVs to detect

you..For details on how to get yours today, email the hackers on : (

atmmachinehackers1@gmail.com < Tell your

loved once too, and start to live large. That's the simple testimony of how

my life changed for good…Love you all .