One of the many roses flowering in the garden this week

Last week just zipped by, so here I am posting my five frugal things a day late. Let’s just pretend it’s Friday.

In a rare social whirl, I went out for drinks last Friday night, followed by a family trip to London to meet friends for a picnic in St James’ Park. I then had work to finish before meetings on Tuesday, an event back in London on Wednesday, sports day on Thursday and catching up with everything else on Friday.

Somewhere along the way we fitted in five frugal things, so here they are!

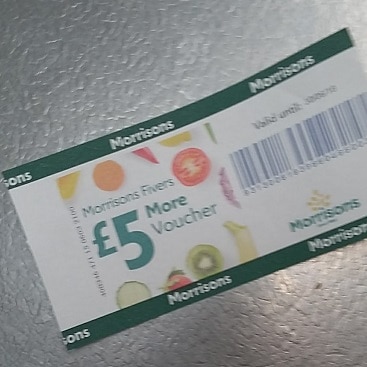

Action shot at the checkout

Used supermarket loyalty card vouchers to cut food costs

As blogged yesterday in my post about the story of a shopping list, I’m trying to cut our food costs during June.

Vouchers from supermarket loyalty schemes come in very handy if you want to slash your food shopping bills. In addition to the £17 East of England Co-op dividends I mentioned last week, I also used a £2 off a £15 spend Co-op voucher and a £5 voucher from my Morrisons More card. No point turning down free money!

Boxes full of smugness

Saved with batch cooking

In an uncharacteristic feat of organisation, I actually did some batch cooking last Sunday. I used one pack of mince to make both bolognaise sauce, which we ate that night, plus a portion of chilli con carne for later in the week. While the oven was on for roasted potatoes, I also made the roasted veg shown above.

Batch cooking is a brilliant way of saving:

- Saves time, if you’re prepping several meals at once

- Saves energy, if you fill the oven rather than using it twice

- Saves food waste, if you cook food while it’s still fresh

- Saves on lunch costs, if you (or your other half) take a portion as a packed lunch instead of buying a sandwich

- Saves the risk of an expensive takeaway, if you’re facing a busy week when you might not have the time or energy to cook

Hopefully if I remember all these benefits I’ll actually get round to batch cooking more often.

Signed up for a credit card to earn £25

I know some people view credit cards as the work of the devil and a direct route to financial hell.

Personally, I reckon credit cards can be really handy so long as you don’t spend money you can’t afford (however tempting) and always pay off your balance in full at the end of the month.

Anyway, First Direct was willing to offer £30 to customers signing up for an interest-free balance transfer card. To claim the cash, you had to transfer a balance of at least £100 onto the card, pay a 2.29% fee with a £5 minimum, and then leave the balance on the card for at least 90 days.

It only took a few minutes to fill in the application form online. I logged in a couple of days later to transfer £200 from this month’s spending on my usual credit card. I set up a direct debit to pay the minimum payment each month, and now I just have to wait 90 days for the £30 to be paid, and then clear whatever’s left on the card. The card is interest free for well over two years, so after deducting the £5 balance transfer fee, I should pocket £25.

Avoided paying more in pension charges

My husband got a letter earlier this year from his pension provider, touting new funds which charge 0.65% a year and encouraging him to switch so he could pay lower charges. Fees and charges really can eat away at retirement savings, because you’re stashing the money away for so long.

Of course the letter didn’t include anything actually useful, like which fund he was invested in already, and how much that charged. We finally remembered to ring the company this week and it turns out he only pays 0.48% a year anyway – less than the supposedly cheaper charges on the new fund. I guess the frugal message is to look before you leap and always check your charges to avoid getting ripped off.

Ok it wasn’t actually this bus, but I wish it had been.

Saved a taxi fare by taking the bus

Before we moved to Hadleigh, I checked there was a bus route to our nearest station at Manningtree. My mistake was not actually opening the timetable.

Turns out there is only one bus each day to the station at hideously early o’clock, and only one bus back at not remotely late enough. I normally end up doing complicated things with buses and train tickets via Ipswich, or swallow the cost and cab it to and from Manningtree. I’m not the biggest fan of driving at the best of times, and driving home in the middle of the night after an evening out really doesn’t appeal.

This week however I was due at an event in South Kensington at 8.30am in the morning. For the first time ever it made sense to catch the 5.48am bus (ouch) to Manningtree. The silver lining was that the bus ticket only cost £3.10, rather than paying £20 odd for a taxi. Afraid I did end up having a little snooze during one of the less gripping presentations.

Now over to you – any frugal triumphs? Thrifty successes to celebrate? Do share your money-saving moments in the comments!

I’m linking up with Cass, Emma and Becky in this week’s ‘Five fabulously frugal things I’ve done this week’ linky.

Eek that is early isn’t it. Great saving though!

Your list looks great. Here’s what I was up to:

-I continued to sell things from our “new” house that we didn’t want, and made $35 getting rid of things.

-I used a $10 lunch coupon to treat the kids on the first day of summer vacation. Used a gift card to cover the rest.

-Used a $10 grocery coupon to buy ingredients & make M a homemade cake for his birthday

-Took an Uber to the airport (cheaper than parking)

it is a great blog to recommend.